EXHIBIT 99.2

Published on August 1, 2018

Exhibit 99.2

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

To the shareholders of Acasti Pharma Inc. (the “Corporation”):

NOTICE IS HEREBY GIVEN THAT that the annual and special meeting of the shareholders (the “Meeting”) of the Corporation will be held at the offices of Osler, Hoskin & Harcourt LLP, located at 1000 De La Gauchetière Street West, Suite 2100, Montreal, Québec H3B 4W5, Canada, on August 28, 2018 at 10:00 a.m., for the following purposes:

| 1. | to receive the financial statements of the Corporation for the financial year ended March 31, 2018 and the auditors’ report thereon; |

| 2. | to elect the directors of the Corporation (the “Directors”) for the ensuing year; |

| 3. | to appoint the auditors for the ensuing year and to authorize the Directors of the Corporation to fix their remuneration; |

| 4. | to consider and, if deemed appropriate, to pass, with or without variation, an ordinary resolution approving, ratifying and confirming certain amendments to the Corporation’s stock option plan, as previously approved by the board of Directors of the Corporation (the “Board”), as more particularly described in the accompanying management information circular (the “Circular”); |

| 5. | to consider and, if deemed appropriate, to pass, with or without variation, an ordinary resolution approving, ratifying and confirming the grant of 1,412,423 options to purchase Common Shares of the Corporation to certain executives and Board members, as previously approved by the Board, as more particularly described in the Circular; |

| 6. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution approving, ratifying and confirming certain amendments to the Corporation’s equity incentive plan, as previously approved by the Board, as more particularly described in the Circular; and |

| 7. | to transact such other business as may properly be brought before the Meeting or any adjournment thereof. |

SIGNED IN LAVAL, QUEBEC, AS AT, July 27, 2018.

By Order of the Board of Directors

/s/ Linda P. O’Keefe

Linda P. O’Keefe

Corporate Secretary

Shareholders may exercise their rights by attending the Meeting or by completing a form of proxy. The Directors of the Corporation have established July 24, 2018 as the record date for the purpose of determining the Corporation’s shareholders which are entitled to receive notice of and to vote at the Meeting. Should you be unable to attend the Meeting in person, please complete, date and sign the enclosed form of proxy and return it in the envelope provided for that purpose. Proxies must be received by the transfer agent and registrar of the Corporation, Computershare Investor Services Inc. (Attention: Proxy Department), 100 University Avenue, 9th Floor, Toronto, Ontario, Canada, M5J 2Y1, no less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the day of the Meeting. Your shares will be voted in accordance with your instructions as indicated on the form of proxy, or failing instructions, in the manner set forth in the Circular.

MANAGEMENT INFORMATION CIRCULAR

Unless otherwise indicated, the following information is given as at July 27, 2018 and all amounts in dollars refer to Canadian currency.

SOLICITATION OF PROXIES BY MANAGEMENT

This management information circular (this “Circular”) is provided in connection with the solicitation by the management of Acasti Pharma Inc. (the “Corporation” or “Acasti”) of proxies to be used at the annual and special meeting (the “Meeting”) of the shareholders of the Corporation (the “Shareholders”) to be held at the offices of Osler, Hoskin & Harcourt LLP, located at 1000 De La Gauchetière Street West, Suite 2100, Montreal, Québec H3B 4W5, Canada, on August 28, 2018 at 10:00 a.m., and any adjournment thereof for the purposes set out in the accompanying notice of Meeting (the “Notice of Meeting”). It is expected that the solicitation will be made primarily by mail. However, directors, officers and employees of the Corporation may also solicit proxies by telephone, fax, email or in person. The cost of solicitation of proxies will be borne by the Corporation.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the enclosed form of proxy are directors of the Corporation (“Directors”) or officers of the Corporation. Each Shareholder who is entitled to vote at the Meeting is entitled to appoint a person, who need not be a Shareholder of the Corporation, to represent him or her at the Meeting other than those whose names are printed on the accompanying form of proxy by inserting such other person’s name in the blank space provided in the form of proxy and signing the form of proxy or by completing and signing another proper form of proxy. To be valid, the duly completed form of proxy must be deposited at the offices of Computershare Investor Services Inc. (Attention: Proxy Department), 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 no less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the day of the Meeting or, by a registered Shareholder, with the Secretary or the Chairman of the Meeting at the time and place of the Meeting or any adjournment thereof. The instrument appointing a proxy-holder must be executed by the Shareholder or by his attorney authorized in writing or, if the Shareholder is a corporate body, by its authorized officer or officers.

A Shareholder who has given a proxy may revoke it, as to any motion on which a vote has not already been cast pursuant to the authority conferred by it, by an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing or, if the Shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized. The revocation of a proxy, in order to be acted upon, must be deposited with Computershare Investor Services Inc. (Attention: Proxy Department), 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 at any time but no less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the day of the Meeting, or any adjournment thereof at which the proxy is to be used, or, by a registered Shareholder, with the Secretary or the Chairman of the Meeting on the day of the Meeting or any adjournment thereof, or in any other manner permitted by law.

In addition, a proxy may be revoked by the Shareholder executing another form of proxy bearing a later date and depositing same at the offices of Computershare Investor Services Inc. (Attention: Proxy Department), 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 no less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the day of the Meeting or, by a registered Shareholder, with the Secretary or the Chairman of the Meeting at the time and place of the Meeting or any adjournment thereof or by the Shareholder personally attending the Meeting and voting his or her shares.

EXERCISE OF DISCRETION BY PROXIES

All Class A shares of the Corporation (the “Common Shares”) represented at the meeting by properly executed proxies will be voted and where a choice with respect to any matter to be acted upon has been specified in the instrument of proxy, the Common Shares represented by the proxy will be voted in accordance with such specifications. In the absence of any such specifications, the management designees, if named as proxy, will vote in favour of all the matters set out herein. Instructions with respect to voting will be respected by the persons designated in the enclosed form of proxy. With respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters that may properly come before the Meeting, such Common Shares will be voted by the persons so designated at their discretion. At the time of printing this Circular, management of the Corporation knows of no such amendments, variations or other matters.

1

NON-REGISTERED SHAREHOLDERS

Only registered Shareholders or the persons they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, Common Shares beneficially owned by a person (a “Non-Registered Shareholder”) are registered either:

| (a) | in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of the Common Shares, such as securities dealers or brokers, banks, trust companies, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| (b) | in the name of a clearing agency of which the Intermediary is a participant. In accordance with National Instrument 54-101 of the Canadian Securities Administrators, entitled “Communication with Beneficial Owners of Securities of a Reporting Issuer”, the Corporation has distributed copies of the Notice of Meeting and this Circular (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for distribution to Non-Registered Shareholders. |

Intermediaries are required to forward the Meeting Materials to Non-Registered Shareholders, and often use a service Corporation for this purpose. Non-Registered Shareholders will either:

| (a) | typically, be provided with a computerized form (often called a “voting instruction form”) which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service Corporation, will constitute voting instructions which the Intermediary must follow. The Non-Registered Shareholder will generally be given a page of instructions which contains a removable label containing a bar-code and other information. In order for the applicable computerized form to validly constitute a voting instruction form, the Non-Registered Shareholder must remove the label from the instructions and affix it to the computerized form, properly complete and sign the form and submit it to the Intermediary or its Service Corporation in accordance with the instructions of the Intermediary or service Corporation. In certain cases, the Non-Registered Shareholder may provide such voting instructions to the Intermediary or its service Corporation through the Internet or through a toll-free telephone number; or |

| (b) | less commonly, be given a proxy form which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted to the number of Common Shares beneficially owned by the Non-Registered Shareholder, but which is otherwise not completed. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the proxy form and submit it to Computershare Investor Services Inc. (Attention: Proxy Department), 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1. |

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the Common Shares which they beneficially own.

Should a Non-Registered Shareholder who receives a voting instruction form wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), such Non-Registered Shareholder should print his or her own name, or that of such other person, on the voting instruction form and return it to the Intermediary or its service Corporation. Should a Non-Registered Shareholder who receives a proxy form wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should strike out the names of the persons set out in the proxy form and insert the name of the Non-Registered Shareholder or such other person in the blank space provided and submit it to Computershare Investor Services Inc. at the address set out at (b) above.

In all cases, Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when, where and by what means the voting instruction form or proxy form must be delivered.

A Non-Registered Shareholder may revoke voting instructions which have been given to an Intermediary at any time by written notice to the Intermediary.

RECORD DATE

Shareholders registered as at July 24, 2018 (the “Record Date”) are entitled to attend and vote at the Meeting. Shareholders who wish to be represented by proxy at the Meeting must, to entitle the person appointed by the proxy to attend and vote, deliver their proxies at the place and within the time set forth in this Circular.

2

VOTING SHARES

The Corporation’s authorized capital consists of an unlimited number of no par value Common Shares and an unlimited number of no par value Class B, Class C, Class D and Class E preferred shares (collectively the “Preferred Shares”), issuable in one or more series.

The Corporation’s Common Shares were consolidated on October 15, 2015 (the “Consolidation”), on the basis of one (1) post-Consolidation Common Share for every ten (10) pre-Consolidation Common Shares, and each fractional Common Share resulting from the consolidation was rounded up (the “Reverse-Split”).

As at the Record Date, there were a total of 36,628,063 Common Shares issued and outstanding and no Preferred Shares issued and outstanding. Each Common Share entitles its holder to one (1) vote.

The by-laws of the Corporation provide that during any meeting of the Shareholders, the attendance, in person or by proxy, of the Shareholders representing ten percent (10%) of the Common Shares shall constitute a quorum, provided that quorum shall not be less than two persons.

PRINCIPAL SHAREHOLDERS

Other than as set forth below, as at the Record Date, to the best knowledge of the Corporation, no corporation and no Director or executive officer (“Executive Officer”) of the Corporation or other person beneficially owns, or controls or directs, directly or indirectly, voting securities carrying ten percent (10%) or more of the voting rights attached to the Corporation’s Common Shares.

| Name and address of Shareholder | Number of Common Shares held | % of Voting Rights represented by the Common Shares | ||||||||

| Neptune Technologies & Bioressources Inc. (“Neptune”) (1) | 5,064,694 | 13.83% | ||||||||

| (1) | On the basis of information available on SEDI (www.sedi.ca) as of the Record Date. |

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

To the best of the Corporation’s knowledge, no one who has been a (i) Director or Executive Officer of the Corporation at any time since the beginning of the Corporation’s last financial year; (ii) a proposed nominee for election as a Director of the Corporation and (iii) an associate or affiliate of the persons listed in (i) and (ii) above, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise in any matter to be acted upon, other the interest of those individuals referred to above who are eligible participants in the Amended Stock Option Plan (as defined below) or the Equity Incentive Plan (as defined below), which are proposed to be amended as described in this Circular.

PARTICULARS OF MATTERS TO BE ACTED UPON

PRESENTATION OF FINANCIAL STATEMENTS

The annual audited financial statements for the fiscal year ended March 31, 2018 (“Fiscal 2018”) and the report of the auditors thereon (the “Annual Report”) will be placed before the Meeting. The Annual Report was mailed to Shareholders who requested a copy and is also available on SEDAR at www.sedar.com and the Corporation’s website at www.acastipharma.com.

ELECTION OF DIRECTORS

The Corporation’s articles currently provide that the board of directors of the Corporation (the “Board” or the “Board of Directors”) may consist of a maximum of ten (10) directors (the “Directors”). The Board has determined to nominate each of the four (4) persons listed below for election as a Director at the Meeting. The Corporation’s Board is currently composed of four (4) Directors. The Board recommends that Shareholders vote FOR the election of each of the four (4) nominees as Directors.

3

The persons named in the enclosed form of proxy intend to vote for the election of the four (4) nominees whose names are set forth below. Management does not contemplate that any such nominees will be unable to serve as a director of the Corporation. However, if, for any reason, any of the proposed nominees do not stand for election or are unable to serve as such, proxies in favour of management designees will be voted for another nominee at their discretion unless the Shareholder has specified in his proxy that his shares are to be withheld from voting in the election of Directors.

The Directors are appointed at each annual meeting of the Shareholders to hold office for a term expiring at the close of the next annual meeting or until their respective successors are elected or appointed and will be eligible for re-election. A director appointed by the Board between meetings of Shareholders or to fill a vacancy will be appointed for a term expiring at the conclusion of the next annual meeting or until his or her successor is elected or appointed and will be eligible for election or re-election.

Majority Voting Policy

The Corporation’s Board adopted a policy that entitles each Shareholder to vote for each nominee on an individual basis. The policy also stipulates that if the votes in favour of the election of a director represent less than a majority of the Common Shares voted and withheld, the nominee will submit his or her resignation promptly after the Meeting for the consideration of the Board. After reviewing the matter, the Board’s decision whether to accept or reject the resignation offer will be disclosed to the public within ninety (90) days of the Meeting. The Board has discretion to accept or reject a resignation. The nominee will not participate in any Board deliberations on the resignation offer. The policy does not apply in circumstances involving contested elections.

Nominees for Election as Director

The following table sets out the name and the province and country of residence of each of the persons proposed for election as Directors, and all other positions and offices with the Corporation held by such person, his or her principal occupation, the year in which the person became a director of the Corporation, and the number of Common Shares of the Corporation that such person has declared to beneficially own, directly or indirectly, or over which control or direction is exercised by such person as at the Record Date.

| Name, province or state, as the case may be, and country of residence of each director and proposed director | Principal Occupation | First year as director | Number of Common Shares beneficially owned or controlled or directed by each proposed director | |||

| Roderick

N. Carter California, United States Chairman of the Board |

Principal, Aquila Life Sciences LLC | 2015 | - | |||

| Jean-Marie (John) Canan Florida, United States |

Corporate Director | 2016 | 57,500 | |||

| Janelle (Jan) D’Alvise California, United States |

President and CEO of the Corporation | 2016 | 52,500 | |||

| Donald Olds Quebec, Canada |

President and CEO of the NEOMED Institute | 2018 | - |

The information as to the number of Common Shares beneficially owned or over which the above-named individuals exercise control or direction and the foregoing information, is not within the knowledge of the Corporation and has been furnished by the respective nominees individually.

The following is a brief biography of the nominees:

Roderick N. Carter, M.D. – Chairman of the Board of Directors

Dr. Carter has a strong history of contributions to healthcare through clinical, research, business and people leadership. He has significant experience developing and commercializing nutraceutical and pharmaceutical products and has successfully led clinical research and business development strategies for cardiovascular and inflammation related diseases. Dr. Carter is currently Principal at Aquila Life Sciences LLC, a consulting firm he founded in April 2008 focusing on pharmaceutical development and commercialization. Prior to this, he was Vice President of Clinical Development at Reliant Pharmaceuticals, which developed the OM3 cardiovascular drug LOVAZA, and today is a wholly-owned subsidiary of GlaxoSmithKline. He also served as Executive Director at Merck and Co., USA, President and Chief Executive Officer of WellGen and Senior Medical Director at Pfizer Inc., USA. Dr. Carter received his Medical Degree from the University of Witwatersrand, Johannesburg, along with a Master of Science degree in Sports Medicine from Trinity College, Dublin.

4

Jean-Marie (John) Canan, CPA – Director

Mr. Canan is an accomplished business executive with over thirty-four (34) years of strategic, business development and financial leadership experience. Mr. Canan recently retired from Merck & Co., Inc. where his last senior position was as Senior Vice-President, Global Controller, and Chief Accounting Officer for Merck from November 2009 to March 2014. He has managed all interactions with the audit committee of the Merck board of directors, while participating extensively with the main board and the compensation & benefits committee. Mr. Canan serves as a director of REV Group, a public company, where he chairs the audit committee. Mr. Canan also provides consulting services to Willow BioPharma, a Canadian start-up, engaged in the acquisition and development of legacy pharmaceutical assets. Willow was recently acquired by Vivus, Inc. He also serves on the board of trustees of Angkor Hospital for Children, where he also chairs the audit & risk committee. Mr. Canan is a graduate of McGill University, Montreal, Canada, and is a Canadian Chartered Accountant.

Janelle (Jan) D’Alvise – Director, President and Chief Executive Officer

Ms. D'Alvise has extensive experience in diagnostics, medical devices, pharmaceuticals and drug discovery research tools. Until recently, Ms. D’Alvise was the President and Chairman of Pediatric Bioscience. Before that, she was the CEO of Gish Biomedical, a cardiopulmonary medical device company. Prior to Gish, Ms. D’Alvise was the CEO of the Sidney Kimmel Cancer Center (SKCC), a drug discovery research institute. From 1995 until 1998, she was also the Co-Founder and Executive VP/COO of Metrika Inc., and in 1999 was the Co- Founder/President/CEO/Chairman of NuGEN, Inc. Ms. D’Alvise built both companies from technology concept through to successful regulatory approvals, product introduction and sustainable revenue growth. Prior to 1995, Ms. D’Alvise was a VP of Drug Development at Syntex/Roche and Business Unit Director of their Pain and Inflammation business, and also VP of Commercial Operations at SYVA, (Syntex's clinical diagnostics division), and began her career with Diagnostic Products Corporation. Ms. D’Alvise has a B.S. in Biochemistry from Michigan Technological University. She has completed post- graduate work at the University of Michigan, Stanford University, and the Wharton Business Schools. Ms. D'Alvise has served on the board of numerous private companies and non-profits, and is an Entrepreneur-in-Residence for the von Liebig Institute for Entrepreneurship at the University of California, San Diego.

Donald Olds - Director

Mr. Olds is President and Chief Executive Officer of the NEOMED Institute, an R&D organization dedicated to advancing Canadian research discoveries to commercial success. Prior to NEOMED, he was the Chief Operating Officer of Telesta Therapeutics Inc., a TSX-listed biotechnology company, where he was responsible for finance and investor relations, manufacturing operations, business development, human resources and strategy. In 2016, he led the successful sale of Telesta to a larger public biotechnology company. Prior to Telesta, he was President and Chief Executive Officer of Presagia Corp., and Chief Financial Officer and Chief Operating Officer of Aegera Therapeutics, where he was responsible for clinical operations, business development, finance, and mergers and acquisitions. At both Telesta and Aegera, Mr. Olds was responsible for raising more than $100 million in equity financing and leading regional and global licensing transactions with life sciences companies. Mr. Olds is currently Director of Goodfood Market Corp, Chairman of Oxfam Quebec and Director of Presagia Corp. He has extensive past corporate governance experience serving on the boards of private and public for-profit and not-for-profit organizations. He holds an MBA (Finance & Strategy) and M.Sc. (Renewable Resources) from McGill University.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

To the knowledge of the Corporation, none of the proposed Directors is, or has been, as at the date of this Circular or within the ten (10) years prior to the date of this Circular, a director, chief executive officer (“CEO”) or chief financial officer (“CFO”) of any corporation (including the Corporation) that:

| (a) | was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the relevant Corporation access to any exemption under applicable securities legislation, that was in effect for a period of more than thirty (30) consecutive days (an “Order”), that was issued while the Director or Executive Officer was acting in the capacity as Director, CEO or CFO; or |

5

| (b) | was subject to an Order that was issued after the Director or Executive Officer ceased to be a director, CEO or CFO and which resulted from an event that occurred while that person was acting in the capacity as director, CEO or CFO. |

To the knowledge of the Corporation, none of the proposed Directors of the Corporation:

| (a) | is, or has been, as at the date of this Circular or within the ten (10) years prior to the date of this Circular, a director or executive officer of any corporation (including the Corporation) that, while that person was acting in that capacity, or within one (1) year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (b) | has, within the ten (10) years prior to the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver, receiver manager or trustee appointed to hold the assets of the proposed director, with the exception of (i) Ms D’Alvise, who was the CEO and a board member of Pediatric Bioscience, Inc. a private company that, due to a failed pivotal clinical trial, filed a motion for bankruptcy under Chapter 7 of the U.S. Bankruptcy Code, in the United States Bankruptcy Court, Southern District of California (San Diego), on March 2, 2016. The trustee issued a final report in April 2017. |

To the knowledge of the Corporation, no proposed director has been subject to:

| (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director. |

Voting for election of Directors is by individual voting and not by slate voting. You can vote your shares for the election of all of these nominees as Directors of the Corporation; or you can vote for some of these nominees for election as Directors and withhold your votes for others; or you can withhold all of the votes attaching to the shares you own and, thus, not vote for the election of any of these nominees as Directors of the Corporation.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE IN FAVOUR OF THE ELECTION OF THE PROPOSED NOMINEES AS DIRECTORS OF THE CORPORATION FOR THE ENSUING YEAR.

The voting rights pertaining to Common Shares represented by duly executed proxies in favour of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary, FOR the election of the proposed nominees as Directors of the Corporation for the ensuing year.

APPOINTMENT OF AUDITORS

At the Meeting, Shareholders will be asked to appoint the firm of KPMG LLP to hold office as the Corporation’s auditors until the close of the next annual meeting of Shareholders and to authorize the Board of Directors to fix their remuneration. The auditors will hold office until the next annual meeting of Shareholders or until their successors are appointed. KPMG LLP has been acting as auditors for the Corporation since September 25, 2006.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE IN FAVOUR OF THE APPOINTMENT OF KPMG LLP AS, as auditors for the Corporation and to authorize the Board to determine their remuneration.

The voting rights pertaining to Common Shares represented by duly executed proxies in favour of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary, FOR the appointment of KPMG LLP, as auditors for the Corporation and to authorize the Board to determine their remuneration.

6

For Fiscal 2018 and the financial year ended March 31, 2017, the Corporation was billed the following fees for audit, audit-related, tax, and all other services provided to the Corporation by its external auditor, KPMG LLP:

| Financial Year Ended March 31, 2018 | Financial Year Ended March 31, 2017 | |||||||

| Audit Fees (1) | $ | 349,100 | $ | 235,400 | ||||

| Audit-Related Fees (2) | $ | 8,440 | $ | 6,550 | ||||

| Tax Fees (3) | $ | 57,100 | $ | 31,600 | ||||

| All Other Fees (4) | - | - | ||||||

| Total Fees Paid | $ | 414,640 | $ | 273,550 | ||||

| (1) | “Audit fees” consist of fees for professional services for the audit of the Corporation’s annual financial statements, interim reviews and limited procedures on interim financial statements, securities filings and consultations on accounting or disclosure issues. Approximately $211,000 in fees billed during Fiscal 2018 were associated with the December 2017 F-1 public financing and the filing of the F-3 registration statement in March 2018 and approximately $144,000 in fees billed during Fiscal 2017 were associated with the February 2017 public financing. |

| (2) | “Audit-related fees” consist of fees for professional services that are reasonably related to the performance of the audit or review of the Corporation’s financial statements and which are not reported under “Audit Fees” above. |

| (3) | “Tax fees” consist of fees for professional services for tax compliance, tax advice and tax planning. Tax fees include, but are not limited to, preparation of tax returns. |

| (4) | “Other fees” include all other fees billed for professional services other than those mentioned hereinabove. |

APPROVAL OF AMENDED STOCK OPTION PLAN

The Corporation’s stock option plan (the “Stock Option Plan”), in its current form, was last approved by Shareholders at a meeting held on August 15, 2017. For a description of the principal terms of the Stock Option Plan, see “Compensation Discussion and Analysis - Stock Option Plan” below. On July 27, 2018, the Board approved amendments to the existing limits of Common Shares reserved for issuance under the Stock Option Plan as described below, which are subject to Shareholder approval.

At the Meeting, Shareholders will be asked to consider a resolution to approve the following amendments to the Stock Option Plan:

| (a) | an amendment in order to increase the fixed number of Common Shares that may be issued upon the exercise of all options granted under the plan, from 2,940,511 (representing twenty percent (20%) of the number of Common Shares issued and outstanding, as of March 31, 2017) to fifteen percent (15%) of the issued and outstanding Common Shares as of June 27, 2018, representing 5,494,209 Common Shares, which includes the 2,940,511 Common Shares reserved for outstanding options under the Stock Option Plan as at the Record Date (representing approximately eight percent (8%) of the issued and outstanding Common Shares as of the Record Date) and an additional reserve of 2,553,698 Common Shares reserved for issuance for additional grants (representing approximately seven percent (7%) of the issued and outstanding Common Shares as of the Record Date); and |

| (b) | an amendment to provide that all options granted to a director will be vested evenly on a quarterly basis over a period of at least eighteen (18) months, and that all options granted to an employee will be vested evenly on a quarterly basis over a period of at least thirty-six (36) months; |

(the “Amended Stock Option Plan”)

The Stock Option Plan prescribes various limits to the number of Common Shares that can be reserved for issuance for specific grants made under the Stock Option Plan. A copy of the proposed Amended Stock Option Plan can be obtained by contacting the Corporation’s Corporate Secretary.

The proposed amendments to the Stock Option Plan are necessary for the Corporation to be able to continue implementing its compensation plan and provide the Corporation with the flexibility to award grants under the Amended Stock Option Plan to achieve appropriate equity incentives.

The Amended Stock Option Plan must be approved by a majority of the votes cast by all Shareholders at the Meeting who are not Insiders to whom stock options may be granted under the Stock Option Plan and their associates (the “Disinterested Shareholders”). As at the Record Date, and based on the information available to the Corporation, holders of 147,000 Common Shares are not entitled to vote on the resolution to approve the Amended Stock Option Plan.

7

Accordingly, Disinterested Shareholders will be asked to consider, and if deemed advisable, to pass, with or without variation, the following ordinary resolution (the “Amended Stock Option Plan Resolution”):

RESOLVED THAT:

| 1. | the amended stock option plan (the “Amended Stock Option Plan”) of Acasti Pharma Inc. (the “Corporation”), as described in the management information circular dated July 27, 2018, is hereby approved, ratified and confirmed; |

| 2. | the Board of Directors of the Corporation be and is hereby authorized on behalf of the Corporation to make any amendments to the Amended Stock Option Plan as may be required by regulatory authorities or otherwise made necessary by applicable legislation, without further approval of the Shareholders of the Corporation, in order to ensure the adoption and efficient function of the Amended Stock Option Plan; and |

| 3. | any director or officer of the Corporation be and is hereby authorized and directed to do such things and to execute and deliver all such instruments, deeds and documents, and any amendments thereto, as may be necessary or advisable in order to give effect to the foregoing resolutions, and to complete all transactions in connection with the implementation of the Amended Stock Option Plan. |

THE BOARD OF DIRECTORS BELIEVES THE PASSING OF THE AMENDED STOCK OPTION PLAN RESOLUTION IS IN THE BEST INTEREST OF THE CORPORATION AND RECOMMENDS THAT SHAREHOLDERS OF THE CORPORATION VOTE IN FAVOUR OF THE AMENDED STOCK OPTION PLAN RESOLUTION.

The voting rights pertaining to shares represented by duly executed proxies in favor of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary, FOR the Amended Stock Option Plan Resolution.

RATIFICATION OF STOCK OPTION GRANTS

Shareholders will be asked to approve a resolution (the “Option Grant Resolution”) as set forth below to approve, ratify and confirm a previous grant of a total of 1,412,423 options to purchase Common Shares of the Corporation to certain directors and officers of the Corporation.

In accordance with the Corporation’s compensation policy and in order to provide appropriate long-term compensation and to align the interests of directors and officers with the interests of Shareholders, the Board granted 1,412,423 options to purchase Common Shares of the Corporation with an exercise price of CDN $0.77 per share and a term of ten (10) years to certain directors and officers of the Corporation under the Stock Option Plan on July 2, 2018 (the “Granted Options”). As the grant of the Granted Options was made in excess of the then applicable limit of Common Shares reserved for issuance under the Stock Option Plan, the Granted Options are subject to the approval of the Shareholders, excluding the votes of the recipients of the Granted Options.

The Granted Options must be approved by a simple majority of votes cast by Disinterested Shareholders at the Meeting. As at the Record Date, and based on information available to the Corporation, holders of 147,000 Common Shares are not entitled to vote on the resolution approving and ratifying the Granted Options.

Accordingly, Shareholders, excluding certain directors and officers of the Corporation, will be asked to consider, and if deemed advisable, to pass, with or without variation, the following ordinary resolution:

BE IT RESOLVED THAT:

1. The Granted Options, the whole as described in the management information circular dated July 27, 2018, are hereby approved, ratified and confirmed.

2. Any director or officer of Acasti Pharma Inc. be and is hereby authorized and directed to do such things and to execute and deliver all such instruments, deeds and documents, and any amendments thereto, as may be necessary or advisable in order to give effect to the foregoing resolutions, and to complete all transactions in connection with the implementation of the Granted Options.

THE BOARD OF DIRECTORS BELIEVES THE PASSING OF THE OPTION GRANT RESOLUTION IS IN THE BEST INTEREST OF THE CORPORATION AND RECOMMENDS THAT SHAREHOLDERS OF THE CORPORATION VOTE IN FAVOUR OF THE OPTION GRANT RESOLUTION.

The voting rights pertaining to shares represented by duly executed proxies in favor of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary, FOR the Option Grant Resolution.

8

Approval of AMENDED EQUITY INCENTIVE Plan

The Corporation’s equity incentive plan (the “Equity Incentive Plan”), in its current form, was last approved by Shareholders at a meeting held on August 15, 2017. For a description of the principal terms of the Equity Incentive Plan, see “Compensation Discussion and Analysis - Equity Incentive Plan” below. On July 27, 2018, the Board approved amendments to the existing limits of Common Shares reserved for issuance under the Equity Incentive Plan, as described below, which are subject to Shareholder approval.

At the Meeting, Shareholders will be asked to consider a resolution to approve amendments to the Equity Incentive Plan (i) to set the total number of Common Shares reserved for issuance pursuant to awards granted under the Equity Incentive Plan to an aggregate number that if, and for so long as the Common Shares are listed on the TSXV, shall not exceed the lower of (x) 915,701 Common Shares (representing 2.5% of the number of Common Shares issued and outstanding as of June 27, 2018), up from 367,563 Common Shares (representing 2.5% of the number of Common Shares issued and outstanding as of March 31, 2017), and (y) fifteen percent (15%) of the issued and outstanding Common Shares as of June 27, 2018, representing 5,494,209 Common Shares (up from 2,940,511 Common Shares representing twenty percent (20%) of the number of Common Shares issued and outstanding as of March 31, 2017), which number shall include Common Shares issuable pursuant to options issued under the Amended Stock Option Plan (the “Amended Equity Incentive Plan”).

Under the current term of the Equity Incentive Plan and before the implementation of the proposed amendment, as of the Record Date, no Common Shares were issuable under the Equity Incentive Plan. Further, the Equity Incentive Plan prescribes various limits to the number of Common Shares that can be reserved for issuance for specific grants made under the Equity Incentive Plan. A copy of the proposed Amended Equity Incentive Plan can be obtained by contacting the Corporation’s Corporate Secretary.

The proposed amendments to the Equity Incentive Plan are necessary for the Corporation to be able to continue implementing its compensation mode and provide the Corporation with the flexibility to award grants under the Amended Equity Incentive Plan to achieve appropriate equity incentives.

The Amended Equity Incentive Plan must be approved by a majority of the votes cast by all Disinterested Shareholders at the Meeting. As at the Record Date, and based on the information available to the Corporation, holders of 147,000 Common Shares are not entitled to vote on the resolution to approve the Amended Equity Incentive Plan.

Accordingly, Disinterested Shareholders will be asked to consider, and if deemed advisable, to pass, with or without variation, the following ordinary resolution (the “Amended Equity Incentive Plan Resolution”):

RESOLVED THAT:

| 1. | the amended equity incentive plan (the “Amended Equity Incentive Plan”) of Acasti Pharma Inc. (the “Corporation”), as set forth in the management information circular dated July 27, 2018, is hereby approved, ratified and confirmed; |

| 2. | the Board of Directors of the Corporation be and is hereby authorized on behalf of the Corporation to make any amendments to the Amended Equity Incentive Plan as may be required by regulatory authorities or otherwise made necessary by applicable legislation, without further approval of the Shareholders of the Corporation, in order to ensure the adoption and efficient function of the Amended Equity Incentive Plan; and |

| 3. | any director or officer of the Corporation be and is hereby authorized and directed to do such things and to execute and deliver all such instruments, deeds and documents, and any amendments thereto, as may be necessary or advisable in order to give effect to the foregoing resolutions, and to complete all transactions in connection with the implementation of the Amended Equity Incentive Plan. |

THE BOARD OF DIRECTORS BELIEVES THE PASSING OF THE AMENDED EQUITY INCENTIVE PLAN RESOLUTION IS IN THE BEST INTEREST OF THE CORPORATION AND RECOMMENDS THAT SHAREHOLDERS OF THE CORPORATION VOTE IN FAVOUR OF THE AMENDED EQUITY INCENTIVE PLAN RESOLUTION.

The voting rights pertaining to shares represented by duly executed proxies in favor of the persons named in the accompanying form of proxy will be exercised, in the absence of specifications to the contrary, FOR the Amended Equity Incentive Plan Resolution.

9

OTHER MATTERS

Management of the Corporation knows of no other matters to come before the Meeting other than those referred to in the Notice of Meeting. However, if any other matters that are not known to management should properly come before the Meeting, the accompanying form of proxy confers discretionary authority upon the persons named therein to vote on such matters in accordance with their best judgment.

Compensation Discussion and Analysis

“Named Executive Officer” (or “NEO”) means: (a) a CEO, (b) a CFO, (c) each of the three most highly compensated Executive Officers of the Corporation, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and the CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000, and (d) each individual who would be an NEO under paragraph (c) above but for the fact that the individual was neither an Executive Officer of the Corporation or its subsidiaries, nor acting in a similar capacity, at the end of that financial year.

During Fiscal 2018, the Corporation had four (4) Named Executive Officers of the Corporation, being, Jan D’Alvise, President & CEO as of June 1, 2016, Linda P. O’Keefe, CFO as of November 27, 2016 and Corporate Secretary as of August 30, 2017, Pierre Lemieux, Chief Operating Officer (“COO”) and Laurent Harvey, Vice President, Clinical and Non-Clinical Affairs.

Compensation Governance

Compensation of Executive Officers and Directors of the Corporation is recommended to the Board of Directors by the Governance and Human Resources Committee (the “GHR Committee”). In its review process, the GHR Committee relies on input from management on the assessment of executives and Corporation performance.

During Fiscal 2018, the GHR Committee was composed of the following members, each of whom is independent: Dr. Staal, acting as chairperson until his resignation on January 13, 2018, Dr. Carter and Mr. Canan. The GHR Committee establishes management compensation policies and oversees their general implementation. All members of the GHR Committee have direct experience which is relevant to their responsibilities as GHR Committee members. All members are or have held senior executive or director roles within significant businesses, several also having public companies experience, and have a good financial understanding which allows them to assess the costs versus benefits of compensation plans. The members combined experience in the Corporation’s sector provides them with the understanding of the Corporation’s success factors and risks, which is very important when determining metrics for measuring success. As at the date of this Circular, the GHR Committee is composed of Dr. Carter, Mr. Canan and Mr. Olds, each of whom is independent.

Risk management is a primary consideration of the GHR Committee when implementing its compensation program. It does not believe that its compensation program results in unnecessary or inappropriate risk taking, including risks that are likely to have a material adverse effect on the Corporation. Payments of bonuses, if any, are not made unless performance goals are met.

For executives, more than half of target direct compensation (base salary + target STIP (as defined below) + target LTIP (as defined below) is considered “at risk”. This mix results in a strong pay-for-performance relationship and an alignment with Shareholders and is competitive with other firms of comparable size in similar fields. The CEO (or any person acting in that capacity) makes recommendations to the GHR Committee as to the compensation of the Corporation’s Executive Officers, other than herself, for approval by the Board. The GHR Committee makes recommendations to the Board of Directors as to the compensation of the CEO, for approval. The CEO’s salary is based on comparable market consideration and the GHR Committee’s assessment of her performance, with regard to the Corporation’s financial performance and progress in achieving strategic performance.

Qualitative factors beyond the quantitative financial metrics are also a key consideration in determination of individual executive compensation payments. How executives achieve their financial results and demonstrate leadership consistent with the Corporation’s values are key to individual compensation decisions.

Summary of the Corporation’s Compensation Programs

The Corporation’s executive compensation program is intended to attract, motivate and retain high performing senior executives, encourage and reward superior performance and align the executives’ interests with those of the Corporation by providing a compensation which is competitive with the compensation received by executives employed by comparable companies and ensuring that the achievement of annual objectives is rewarded through the payment of bonuses and providing executives with long-term incentive through the grant of stock options.

10

The Corporation’s GHR Committee has authority to retain the services of independent compensation consultants to advise its members on executive compensation and related matters, and to determine the fees and the terms and conditions of the engagement of those consultants. During Fiscal 2018, the GHR Committee retained compensation consulting services, including those led by The Sarkaria Group to review the Corporation’s executive compensation programs, including base salary, short-term and long-term incentives, total cash compensation levels and total direct compensation of certain senior positions, against those of peer groups of similar and larger size, as measured by market capitalization, biotechnology and pharmaceutical companies listed or headquartered in North America. All of the services provided by the consultants were provided to the GHR Committee. The GHR Committee assessed the independence of the consultants and concluded that its engagement of the consultants did not raise any conflict of interest with us or any of our Directors or Executive Officers. As influenced by the consultants’ executive compensation review of Fiscal 2018, the Board and GHR Committee set the following executive compensation program.

Use of Fixed and Variable Pay Components

Compensation of NEOs is revised each year and has been structured to encourage and reward the Executive Officers on the bases of short-term and long-term corporate performance. In the context of the analysis of the compensation for Fiscal 2018 the following components were examined by the GHR Committee:

| (i) | base salary; |

| (ii) | short term incentive plan (as defined below), consisting of a cash bonus; |

| (iii) | long term incentive plan (as defined below), consisting of stock options and equity incentive grants based on performance and/or time vesting conditions; and |

| (iv) | other elements of compensation, consisting of group benefits and perquisites. |

Base Salary

The Corporation intends to be competitive with comparator companies and to attract and retain top talent. The GHR Committee will review compensation periodically to be sure it meets this strategic imperative. Base salary is set to reflect an individual’s skills, experience and contributions within a salary structure consistent with the Corporation gender pay equity policy. Base salary structure is revised annually by the GHR Committee as the Corporation’s financial and market conditions evolve.

Short Term Incentive Plan (“STIP”)

STIP provides for potential rewards when a threshold of corporate performance is met. Personal objectives that support corporate goals are established annually with each employee and are assessed at the end of each financial year. Personal objectives are assessed through a performance grid, with pre-specified, objective performance criteria. STIP awards are paid out in proportion to individual performance, determined in end-of-year performance reviews. For the most senior participants in the STIP, greater weight is assigned to corporate objectives. Target payout is expressed as a percentage of base salary and is determined by employment contracts and Board discretion. Annual salary for STIP purposes is the annual salary in effect at the end of the plan year (i.e., prior to annual salary increases).

The actual amount awarded ranges from zero for performance well below expectation and is capped at two times target for exceptional performance. The STIP is a discretionary variable compensation plan and all STIP payments are subject to Board approval. Participants must be employed by us at the end of the financial year to qualify. We reserve the right to modify or discontinue the STIP at any time.

Ms. D’Alvise, the Corporation’s CEO, is eligible for up to a fifty percent (50%) bonus of her annual base salary and Ms. O’Keefe, the Corporation’s CFO, is eligible for up to a thirty percent (30%) bonus of her annual base salary. Dr. Lemieux, the Corporation’s COO, is eligible for up to a forty percent (40%) bonus of his annual base salary and Mr. Groch, the Corporation’s Chief Commercial Officer, is eligible for up to a forty percent (40%) bonus of his annual base salary.

These performance goals will take into account the achievement of R&D milestones within timelines and budget, critical operating objectives as well as individual objectives determined annually by the Board according to short-term priorities.

Long Term Incentive Plan (“LTIP”)

The LTIP has been adopted as a reward and retention mechanism. Participation is determined annually at the discretion of the Board. Employees approved by the Corporation’s Board of Directors may participate in the Corporation’s stock option plan, which is designed to align the long-term interests of participants with those of Shareholders, in order to promote Shareholder value.

11

The GHR Committee determines the number of stock options to be granted to a participant based on peer group data and taking into account corporate performance and level in the organization. The LTIP calculation is based on a guideline percentage of base salary and the number of options is determined based on an approved dollar value (rather than a specific number of shares). The guideline ranges from fifteen percent (15%) to two hundred percent (200%) and is subject to adjustment by the Board in reviewing annual achievement of corporate performance and availability of shares. The GHR Committee may also determine, in its sole discretion, ad hoc stock option awards to be granted to participants in order to address extraordinary situations. Awards at any level may be adjusted as necessary to maintain an equity burn rate and overhang similar to comparator companies. In addition to the Corporation’s Stock Option Plan, the Board is also empowered to grant ad hoc awards, from time to time, under the Corporation’s Equity Incentive Plan to provide for a share-related mechanism to attract, retain and motivate qualified Directors, senior employees and consultants.

The Corporation’s Directors and Executive Officers are not permitted to purchase financial instruments, such as prepaid variable forward contracts, equity swaps, collars or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the Director or officer.

Share Ownership Guidelines

To further align the interests of the Corporation’s executives with those of the Corporation’s other Shareholders, the Board has adopted share ownership guidelines. Under these guidelines, the CEO and other executives (i.e., CFO, COO, VPs) are required to retain and hold fifty percent (50%) of the shares acquired by them under any equity incentive award granted on or after June 8, 2017 (after subtracting shares sold to pay for option exercise costs, and relevant federal, state, and local taxes which are assumed to be at the highest marginal tax rates). In addition, the share retention rule applies unless the executive beneficially owns shares with a value at or in excess of the following share ownership guidelines:

| · | CEO — 2x then-current annual base salary |

| · | Other executives — 1x then-current annual base salary. |

The value of an individual’s shares for purposes of the share ownership guidelines is deemed to be the greater of the then-current fair market value of the shares, or the individual’s cost basis in the shares. Shares counted in calculating the share ownership guidelines include shares beneficially owned outright, whether from open market purchases, shares retained after option exercises, and shares of restricted stock or deferred stock units that have fully vested. In addition, in the case of vested, unexercised, in-the-money stock options, the in-the-money value of the stock options will be included in the share ownership calculation. Executives have five (5) years from their date of hire or promotion to satisfy the share ownership guidelines.

Stock Option Plan

The following is a summary of important provisions of the Stock Option Plan. It is not a comprehensive discussion of all of the terms and conditions of the Stock Option Plan. Readers are advised to review the full text of the Stock Option Plan to fully understand all terms and conditions of the Stock Option Plan. A copy of the Stock Option Plan can be obtained by contacting the Corporation’s Corporate Secretary.

The Corporation’s Stock Option Plan was adopted by the Board of Directors on October 8, 2008 and was amended from time to time, including most recently on July 27, 2018.

The grant of options is part of the long-term incentive component of executive and Director compensation and an essential part of compensation. Qualified Directors, employees and consultants of the Corporation and its subsidiaries may participate in the Stock Option Plan, which is designed to encourage optionees to link their interests with those of Shareholders, in order to promote an increase in Shareholder value. Awards and the determination of any exercise price are made by the Board of Directors, after recommendation by the GHR Committee. Awards are established, among other things, according to the role and responsibilities associated with the participant’s position and his or her influence over appreciation in Shareholder value. Any award grants a participant the right to purchase a certain number of Common Shares during a specified term in the future, after a vesting period and/or specific performance conditions, at an exercise price equal to at least 100% of the Market Price (as defined below) of the Corporation’s Common Shares on the grant date. The “Market Price” of Common Shares as of a particular date shall generally mean the closing price per Common Share on the TSXV or any other exchange on which the Common Shares are listed from time to time, for the last preceding date on which there was a sale of such Common Shares on such exchange (subject to certain exceptions set forth in the Stock Option Plan in the event that the Company is no longer traded on any stock exchange). Previous awards may sometimes be taken into account when new awards are considered.

12

In accordance with the provisions of the Stock Option Plan, all of an option holder’s options will immediately vest on the date of a Change of Control event (as such term is defined in the Stock Option Plan), subject to the terms of any employment agreement or other contractual arrangement between the option holder and the Corporation.

Options for Common Shares of the Corporation representing a fixed rate of twenty percent (20%) of the outstanding issued Common Shares of the Corporation as of March 31, 2017 may be granted by the Board pursuant to the Stock Option Plan. As at the Record Date, there were 208,489 Common Shares reserved and available for issuance under the Stock Option Plan. As of the Record Date, there were 2,666,122 options outstanding under the Corporation’s Stock Option Plan.

However, in no case will the grant of options under this plan, together with any proposed or previously existing security based compensation arrangement, result in (in each case, as determined on the grant date): the grant to any one consultant of the Corporation, or any subsidiary of the Corporation, within any twelve (12) month period, of options reserving for issuance a number of Common Shares exceeding in the aggregate two percent (2%) of the Corporation’s issued and outstanding Common Shares (on a non-diluted basis); or the grant to any one employee of the Corporation or any subsidiary of the Corporation, which provides investor relations services, within any twelve (12) month period, of options reserving for issuance a number of Common Shares exceeding in the aggregate two percent (2%) of the Corporation’s issued and outstanding Common Shares (on a non-diluted basis).

Options granted under the Stock Option Plan are non-transferable and are subject to a minimum vesting period of eighteen (18) months, with gradual and equal vesting on no less than a quarterly basis. They are exercisable, subject to vesting and/or performance conditions, at a price equal to the closing price of the Common Shares on the TSXV on the day prior to the grant of such options. In addition, and unless otherwise provided for in the agreement between the Corporation and the holder, options will also lapse upon termination of employment or the end of the business relationship with the Corporation except that they may be exercised for sixty (60) days after termination or the end of the business relationship thirty (30) days for investor relations services employees), to the extent that they will have vested on such date of termination of employment, except in the case of death, disability or retirement where this period is extended to twelve (12) months.

Subject to the approval of the relevant authorities, including the TSXV if applicable, and compliance with any conditions attached to such approval (including, in certain circumstances, approval by disinterested Shareholders) if applicable, the Board of Directors has the right to amend or terminate the Stock Option Plan. However, unless option holders consent to the amendment or termination of the Stock Option Plan in writing, any such amendment or termination of the Stock Option Plan cannot affect the conditions of options that have already been granted and that have not been exercised under the Stock Option Plan.

Subject to the approval of shareholders and as more particularly described in this Circular under “Particulars of Matters to Be Acted Upon – Approval of Amended Stock Option Plan”, on July 27, 2018 the Corporation, on the recommendation and approval of the Board, amended its Stock Option Plan. The proposed amendments provide for an increase to the existing limits for common shares reserved for issuance under the Stock Option Plan as well as certain changes to the minimum vesting period applicable to options granted to directors and employees under the Stock Option Plan.

Burn Rate and Overhang

Shareholders approve the number of Common Shares that can be issued under the Corporation’s Stock Option Plan. In August 2017, shareholders approved an increase of Common Shares reserved for issuance under the Stock Option Plan from 2,142,407 (representing twenty percent (20%) of the number of Common Shares issued and outstanding as of February 29, 2016) to 2,940,511 (representing twenty percent (20%) of the issued and outstanding Common Shares as of March 31, 2017).

13

The following table sets out the burn rate and overhang of the Company’s Stock Option Plan for Fiscal 2018 and Fiscal 2017:

| Financial Year Ended March 31, 2018 | Financial Year Ended March 31, 2017 | |||||||

| Burn Rate (1) | 5.6 | % | 12.9% | (3) | ||||

| Overhang (2) | 10.1 | % | 12.4% | |||||

| (1) | The number of options granted annually, expressed as a percentage of the weighted average number of Common Shares outstanding for each financial year. |

| (2) | The total number of Common Shares reserved for issuance under the Company’s Stock Option Plan, less the number of options redeemed, expressed as a percentage of the total number of Common Shares outstanding as at March 31 of each year on a diluted basis. |

| (3) | Transition year in which Acasti became more independent from Neptune with the hiring of new directors and officers and, therefore, initial option grants above the average annual activity. |

The GHR Committee and the Board review the use of the Stock Option Plan on an annual basis with respect to how the Corporation aligns with the market. The Fiscal 2018 metrics were considered relative to similarly situated life science companies (i.e., <$5,000,000 in revenue and <50 employees) according to compensation data from Radford Equity Trend Analysis: Life Science Edition (November 2017) (the “Radford Study”). The Radford study found that companies similar in size and revenue to the Corporation had burn rates in 2017 ranging from 1.43% to 6.83% with the 50th percentile between 4.27-4.66%. In addition, total overhang for companies in life sciences similarly situated to the Corporation ranged between 12.53% and 22.94% during the same time period with the 50th percentile between 17.42-18.16%. The TSX Venture Exchange caps overhang at 20%.

Equity Incentive Plan

The following is a summary of important provisions of the Equity Incentive Plan. It is not a comprehensive discussion of all of the terms and conditions of the Equity Incentive Plan. Readers are advised to review the full text of the Equity Incentive Plan to fully understand all terms and conditions of the Equity Incentive Plan. A copy of the Equity Incentive Plan can be obtained by contacting the Corporation’s Corporate Secretary.

On May 22, 2013, the Equity Incentive Plan was adopted by the Board in order to, amongst other things, provide the Corporation with a share-related mechanism to attract, retain and motivate qualified Directors, employees and consultants of the Corporation. The adoption of the Equity Incentive Plan was initially approved by the Shareholders at its 2013 Shareholders’ meeting held on June 27, 2013 and has been amended from time to time, including most recently on July 27, 2018.

Eligible Persons may participate in the Equity Incentive Plan. “Eligible Persons” under the Equity Incentive Plan consist of any Director, officer, employee or consultant (as defined in the Equity Incentive Plan) of the Corporation or of a subsidiary. A participant (“Participant”) is an Eligible Person to whom an award has been granted under the Equity Incentive Plan. The Equity Incentive Plan provides the Corporation with the option to grant to Eligible Persons Bonus Shares, Restricted Shares, Restricted Share Units, Performance Share Units, Deferred Share Units and other Share-Based Awards.

Subject to the adjustment provisions provided for in the Equity Incentive Plan and the applicable rules and regulations of all regulatory authorities to which the Corporation is subject (including any stock exchange), the total number of Common Shares reserved for issuance pursuant to awards granted under the Equity Incentive Plan will be equal to a number that (A) if, and for so long as the Common Shares are listed on the TSXV, shall not exceed the lower of (i) 367,563 Common Shares and (ii) twenty percent (20%) of the issued and outstanding Common Shares as of March 31, 2017, representing 2,940,511 Common Shares, which number shall include Common Shares issuable pursuant to options issued under the Stock Option Plan.

If, and for so long as the Common Shares are listed on the TSXV, no more than two percent (2%) of the issued and outstanding Common Shares may be granted to any one consultant or employee conducting investor relations activities in any twelve (12) month period.

The Board has the right to determine that any unvested or unearned Restricted Share Units, Deferred Share Units, Performance Share Units or other Share-Based Awards or Restricted Shares subject to a Restricted Period outstanding immediately prior to the occurrence of a change in control shall become fully vested or earned or free of restriction upon the occurrence of such change in control. The Board may also determine that any vested or earned Restricted Share Units, Deferred Share Units, Performance Share Units or other Share-Based Awards shall be cashed out at the market price as of the date such change in control is deemed to have occurred, or as of such other date as the Board may determine prior to the change in control. Further, the Board shall have the right to provide for the conversion or exchange of any Restricted Share Unit, Deferred Share Unit, Performance Share Unit or other Share-Based Award into or for rights or other securities in any entity participating in or resulting from the change in control.

14

The Equity Incentive Plan is administered by the Board and the Board has sole and complete authority, in its discretion, to determine the type of awards under the Equity Incentive Plan relating to the issuance of Common Shares (including any combination of Bonus Shares, Restricted Share Units, Performance Share Units, Deferred Share Units, Restricted Shares or other Share-Based Awards) in such amounts, to such persons and under such terms and conditions as the Board may determine, in accordance with the provisions of the Equity Incentive Plan and the recommendations made by the GHR Committee.

Subject to the approval of shareholders and as more particularly described in this Circular under “Particulars Of Matters To Be Acted Upon – Approval of Amended Equity Incentive Plan”, on July 27, 2018 the Corporation, on the recommendation and approval of the Board, amended its Equity Incentive Plan. The proposed amendments provide for an increase to the existing limits for common shares reserved for issuance under the Equity Incentive Plan.

Other Forms of Compensation

RRSP Matching Program

Effective June 1, 2016, the Corporation sponsors a voluntary Registered Retired Savings Plan, or RRSP, matching program (the “RRSP Matching Program”) which is open to all eligible employees, including NEOs. The RRSP Matching Program matched employees’ contributions up to a maximum of $1,500 in fiscal year 2018 for eligible employees who participated in the program.

Other than matching contributions under the RRSP Matching Program (which amounts are disclosed in the column entitled “All Other Compensation” in the summary compensation table below), the Corporation does not provide pension or retirement benefits to its Executive Officers or Directors.

Other Benefits and Perquisites

The Corporation’s executive employee benefit program also includes life, medical, dental and disability insurance. These benefits and perquisites are designed to be competitive overall with equivalent positions in comparable organizations. The Corporation does not have any pension plan available for its employees, executives or Directors.

15

Performance Graph

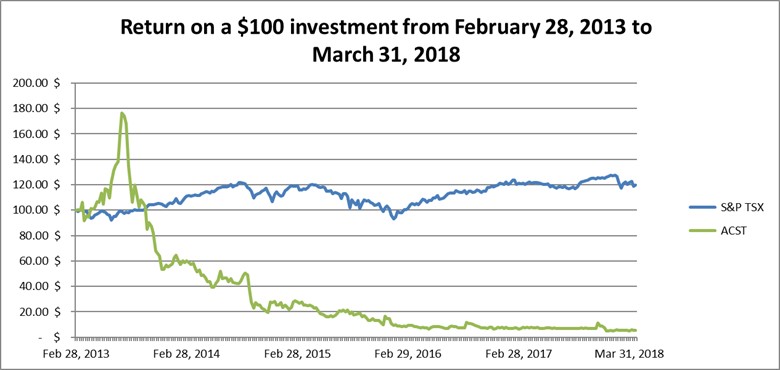

The following graph shows the cumulative return in dollars of a $100 investment in Common Shares of the Corporation, as of February 28, 2013 on the TSXV, compared with the total return of the S&P TSX Composite Index for the period shown on this graph (1).

| (1) | On March 29, 2018, the closing price of the Common Shares of the Corporation on the TSXV was $1.30 per share. |

| Feb. 28, 2013 | Feb. 28, 2014 | Feb. 28, 2015 | Feb. 29, 2016 | Mar. 31, 2017 | Mar. 31, 2018 | |||||||||||||||||||

| NEOs Total Annual Compensation | $ | 1,811,591 | $ | 3,087,762 | $ | 522,291 | $ | 655,297 | $ | 2,239,510 | $ | 2,581,309 | ||||||||||||

| Annual Change (in %) |

- | 70 | % | -83 | % | 25 | % | 242 | % | 15 | % | |||||||||||||

| Acasti TSR | $ | 100.00 | $ | 60.00 | $ | 28.94 | $ | 8.60 | $ | 7.79 | $ | 5.53 | ||||||||||||

| Annual Change (in %) |

- | -40 | % | -52 | % | -70 | % | -9 | % | -29 | % | |||||||||||||

Total annual compensation of the NEOs who were in office at the end of each fiscal year increased by approximately eight percent (8%) when comparing the fiscal year ended March 31, 2018 to fiscal year ended February 28, 2014. Over the same period, the TSR of a $100 investment in the Common Shares, decreased by approximately ninety-four percent (94%). For the fiscal years ended February 28, 2015 and February 29, 2016, total compensation of the NEOs was lower than in other years as the Corporation’s independent management team was not yet fully assembled. The GHR Committee considers a number of factors and performance elements when determining compensation for the members of the executive management. Although total cumulative Shareholder return is one performance measure that is reviewed, it is not the only consideration in executive compensation deliberations. As a result, a direct correlation between total cumulative Shareholder return over a given period and executive compensation levels is not anticipated.

16

COMPENSATION OF NAMED EXECUTIVE OFFICERS

Compensation Paid by the Corporation to Named Executive Officers

The following table sets forth the compensation information for the NEOs during the fiscal year ended March 31, 2018 and the fiscal years ended March 31, 2017 (thirteen-month period) and February 29, 2016.

|

Name and Principal Position |

Period ended |

Salary ($) |

Share-Based Awards (1)(2) ($) |

Option-Based Awards (1)(2) ($) |

Annual Incentive Plans ($) |

All Other Compensation ($) (3) |

Total Compensation ($) |

|

Janelle D’Alvise (4) CEO |

March 31, 2018 | 431,902 | - | 528,279 |

183,500 (6) (42%) |

- | 1,143,681 |

| March 31, 2017 | 365,072 | - | 502,163 |

136,049 (7) (37%) |

- | 1,003,284 | |

|

Linda P. O’Keefe (5) CFO |

March 31, 2018 | 327,199 | - | 159,712 |

64,475 (8) (20%) |

- | 551,386 |

| March 31, 2017 | 114,183 | - | 237,340 |

39,897 (9) (35%) |

109,414 (10) | 500,834 | |

|

Pierre Lemieux COO |

March 31, 2018 | 253,680 | - | 190,426 |

71,155 (28%) |

1,500 | 516,761 |

| March 31, 2017 | 275,819 | - | 96,522 |

49,000 (18%) |

- | 421,341 | |

| February 29, 2016 | 239,565 | - | 33,320 |

42,000 (18%) |

- | 314,885 | |

|

Laurent Harvey (11) Vice President, Clinical and Non-Clinical Affairs |

March 31, 2018 | 187,642 | - | 135,141 |

46,698 (25%) |

- | 369,481 |

| March 31, 2017 | 194,846 | - | 84,205 |

35,000 (18%) |

- | 314,051 | |

| February 29, 2016 | 159,808 | - | 17,153 |

16,000 (10%) |

- | 192,961 |

| (1) | The fair value of stock options is estimated at the grant date using the Black-Scholes option pricing model. This model requires the input of a number of parameters, including share price, share exercise price, expected share price volatility, expected time until exercise and risk-free interest rates. Although the assumptions used reflect management’s best estimates, they involve inherent uncertainties based on market conditions generally outside of our control. |

| (2) | The fair value of the option-based awards granted on June 14, 2017 in the fiscal year ended March 31, 2018 is $1.23. |

| (3) | The value of perquisites and other personal benefits received by these executives did not total an aggregate value of $50,000 or more and does not represent 10% or more of their total salary during the fiscal years ended March 31, 2018, March 31, 2017 and February 29, 2016. |

| (4) | Ms. D’Alvise was appointed the Corporation’s President and CEO on May 11, 2016 and began her functions on June 1, 2016. Her employment agreement provides for payments in U.S. dollars with an annual base salary of US$330,250. In fiscal 2018, Ms D’Alvise earned an annual base salary of US$338,250. |

| (5) | Ms. O’Keefe was appointed our CFO effective as of November 27, 2016. Her employment agreement provides for payments in U.S. dollars with an annual base salary of US$250,000. In fiscal 2018, Ms. O’Keefe earned an annual base salary of US$256,250. |

| (6) | US$142,303 converted as at March 31, 2018, based on a closing exchange rate of US$1.00=$1.2895. |

| (7) | US$102,300, converted as at March 31, 2017, based on a closing exchange rate of US1.00= $1.3299. |

| (8) | US$50,000 converted as at March 31, 2018, based on a closing exchange rate of US1.00= $1.2895. Earned, but US$25,000 payable after FY 2019 event. |

| (9) | US$30,000 converted as at March 31, 2017, based on a closing exchange rate of US$1.00=$1.3299. |

| (10) | Consulting services from July 2016 to November 2016 which provided for payments in U.S. dollars: US$82,273, converted as at March 31, 2017 based on a closing exchange rate of US1.00= $1.3299. |

| (11) | Mr. Harvey resigned effective July 9, 2018. |

17

Outstanding Share-Based and Option-Based Awards

The following tables provide information on the number and value of the outstanding option-based awards held by NEOs at the end of Fiscal 2018. There are no share-based awards outstanding as of March 31, 2018.

Option-Based Awards

| Name / Grant Date | Number of Securities Underlying Unexercised Options (#) | Option Exercise Price ($) (1) | Option Expiration Date |

Value of Unexercised In-The-Money Options (2) ($) |

| Janelle D’Alvise (3) | ||||

| June 14, 2017 | 430,000 | 1.77 | June 14, 2027 | -- |

| May 12, 2016 | 525,000 | 1.56 | May 12, 2023 | -- |

| Linda P. O’Keefe (3) | ||||

| June 14, 2017 | 130,000 | 1.77 | June 14, 2027 | -- |

| February 24, 2017 | 200,000 | 1.65 | February 24, 2027 | -- |

| Pierre Lemieux | ||||

| June 14, 2017 | 155,000 | 1.77 | June 14, 2027 | -- |

| February 24, 2017 | 50,000 | 1.65 | February 24, 2027 | -- |

| May 30, 2016 | 31,400 | 1.99 | May 29, 2023 | -- |

| June 1, 2015 | 16,900 | 4.50 | June 1, 2022 | |

| October 20, 2014 | 7,500 | 6.50 | October 19, 2019 | -- |

| Laurent Harvey (5) | ||||

| June 14, 2017 | 110,000 | 1.77 | June 14, 2027 | -- |

| February 24, 2017 | 50,000 | 1.65 | February 24, 2027 | -- |

| May 30, 2016 | 21,000 | 1.99 | May 29, 2023 | -- |

| June 1, 2015 | 8,700 | 4.50 | June 1, 2022 | -- |

| October 20, 2014 | 2,500 | 6.50 | October 19, 2019 | -- |

|

(1) Option-based awards were consolidated following our share consolidation. The exercise price was increased proportionally to reflect the consolidation.

(2) Calculation was based on a trading price of $1.30 of the Corporation’s common shares on the TSXV, as at closing on March 29, 2018

(3) Ms. D’Alvise was appointed as the Corporation’s President and CEO on May 11, 2016 and began her functions on June 1, 2016.

(4) Ms. O’Keefe was appointed as the Corporation’s CFO effective November 27, 2016.

(5) Mr. Harvey resigned effective July 9, 2018. |

||||

18

Share-Based and Option-Based Awards of the Corporation – Value Vested during Fiscal 2018