EX-99.1

Published on December 5, 2016

Exhibit 99.1

BUSINESS DESCRIPTION OF,

AND

RISK FACTORS RELATING TO,

ACASTI PHARMA INC.

Dated as of December 5, 2016

In this document, unless the context otherwise requires, references to Acasti, the Corporation, we, us, it, its or similar terms refer to Acasti Pharma Inc. and references to Neptune refer to Acastis parent company, Neptune Technologies & Bioressources Inc.

The financial information of the Corporation contained herein are presented in Canadian dollars. All references in this document to dollars, CDN$ and $ refer to Canadian dollars, and references to US$ refer to United States dollars. Potential purchasers should be aware that foreign exchange rate fluctuations are likely to occur from time to time and that the Corporation does not make any representation with respect to future currency values. Investors should consult their own advisors with respect to the potential risk of currency fluctuations. On December 2, 2016, the closing exchange rate for the Canadian dollar, expressed in United States dollars, as quoted by the Bank of Canada was CDN$1.00 = US$0.7528.

This document contains company names, product names, trade names, trademarks and service marks of Acasti, Neptune and other organizations, all of which are the property of their respective owners.

Acasti has applied for trademark protection for CaPre®. The trademark CaPre® is now registered in the United States, Canada, Australia, China, Japan and Europe. Acasti is also the owner of the trademark BREAKING DOWN THE WALLS OF CHOLESTEROL in Canada and the United States.

Unless otherwise indicated, market data and certain industry data and forecasts included in this document concerning our industry and the markets in which we operate or seek to operate were obtained from internal company surveys, market research, publicly available information, reports of governmental agencies and industry publications and surveys. Acasti has relied upon industry publications as its primary sources for third-party industry data and forecasts. Industry surveys, publications and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Acasti has not independently verified any of the data from third-party sources, nor has Acasti ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which Acasti believes to be reliable based upon managements knowledge of the industry, have not been independently verified. By their nature, forecasts are particularly subject to change or inaccuracies, especially over long periods of time. In addition, Acasti does not know what assumptions regarding general economic growth were used in preparing the forecasts cited in this document. While Acasti is not aware of any misstatements regarding Acastis industry data presented herein, Acastis estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under Forward-Looking Information and Risk Factors in this document. While Acasti believes its internal business research is reliable and market definitions are appropriate, neither such research nor definitions have been verified by any independent source. This document may only be used for the purpose for which it has been published.

All financial information contained in this document is presented in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, other than certain non-IFRS financial measures which are defined under Non-IFRS operating loss (net loss before finance costs and income, change in fair value of derivative warrant liabilities, depreciation and amortization, impairment of intangible assets and stock-based compensation), in the Corporations managements discussion and analysis for the fiscal years ended February 29, 2016 and February 28, 2015 and 2014.

FORWARD-LOOKING INFORMATION

This document contains certain information that may constitute forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of U.S. federal securities laws, both of which Acasti refers to as forward-looking information. Forward-looking information can be identified by the use of terms such as may, will, should, expect, plan, anticipate, believe, intend, estimate, predict, potential, continue or other similar expressions concerning

2

matters that are not statements about the present or historical facts. Forward-looking information in this document includes, but is not limited to, information or statements about:

| |

Acastis strategy, future operations, prospects and the plans of management; |

| |

the design, regulatory plan, timeline, costs and results of clinical and nonclinical trials for CaPre; |

| |

the timing and ramp up of patient enrollment; |

| |

the timing of future meetings and discussions with the U.S. Food and Drug Administration (FDA); |

| |

planned regulatory filings for CaPre, and the timing thereof; |

| |

Acastis expectation that its bridging study results will support Acastis plan to get authorization to use the FDAs 505(b)(2) pathway with new chemical entity (NCE) status towards a New Drug Application (NDA) approval in the United States; |

| |

the likelihood of Acasti receiving 5-year exclusivity for CaPre as a NCE; |

| |

the timing and results from two competitor outcomes studies in mild to moderate HTG patients; |

| |

additional clinical trials demonstrating safety and efficacy of CaPre; |

| |

anticipated marketing advantages and product differentiation of CaPre and its potential to become the best-in-class omega-3 (OM3) compound for the treatment of severe hypertriglyceridemia; |

| |

Acastis estimates of the size of the potential market for CaPre, unmet medical needs in such market, potential for market expansion, and the rate and degree of market acceptance of CaPre, if reaching commercialization, and Acastis ability to serve such market; |

| |

the potential to expand CaPres indication for the treatment of mild to moderate hypertriglyceridemia; |

| |

the degree to which physicians would switch their patients to a product with CaPres target product profile; |

| |

Acastis strategy and ability to develop, commercialize and distribute CaPre in the United States and elsewhere; |

| |

Acastis ability to complete business development, marketing and other pre-commercialization activities before reaching commercial launch of CaPre and the estimated timing thereof; |

| |

the completion of production of clinical trial product and manufacturing scale up of CaPre and the timing thereof; |

| |

the potential benefits and risks of CaPre as compared to other products in the pharmaceutical, medical food and natural health products markets, respectively; |

| |

Acastis intention and ability to strengthen its patent portfolio and other means of protecting intellectual property rights; |

| |

Acastis ability to maintain and defend its intellectual property rights; |

| |

the availability and sources of raw materials; |

| |

Acastis expectation to rely on third parties to manufacture CaPre whose manufacturing processes and facilities are in compliance with current good manufacturing practices (cGMP); |

| |

Acastis sales, distribution and marketing strategy for CaPre; |

| |

Acastis intention and ability to obtain and maintain regulatory approvals of CaPre, the timing and costs of obtaining same, and the labeling requirements and other post-market regulation that would apply under any approval Acasti may obtain; |

| |

regulatory developments affecting the pharmaceutical market in the United States and elsewhere; |

| |

the success of competing products that are or become available; |

| |

the potential for omega-3s in other CVM indications; |

| |

the attractiveness of CaPre to larger global, regional or specialty pharmaceutical companies and potential for commercial opportunities in different geographies and indications, including co-development and/or marketing partnerships and possible licensing and partnership opportunities, and the benefits to be derived from such commercial opportunities; |

| |

Acastis intention to pursue development and/or distribution partnerships to support the development and commercialization of CaPre in the United States and in other global markets, and to pursue strategic opportunities to provide development capital, market access and other strategic sources of capital; |

3

| |

Acastis projected capital requirements to fund anticipated expenses, including primarily development and general and administrative expenses, as well as capital expenditures until March 31, 2017; |

| |

Acastis need for additional financing and its estimates regarding future financing and capital requirements; and |

| |

Acastis expectations regarding its financial performance, including its revenues, profitability, research and development, costs and expenses, gross margins, liquidity, capital resources and capital expenditures. |

Although the forward-looking information in this document is based upon what Acasti believes are reasonable assumptions, no person should place undue reliance on such information since actual results may vary materially from the forward-looking information. Certain important assumptions by Acasti in making forward-looking statements include, but are not limited to:

| |

the assumption that the net proceeds of future financing and existing cash, together with interest thereon, should be sufficient to fund Acastis operations through December 31, 2017; |

| |

the successful and timely completion of all required clinical and nonclinical trials that may be necessary for regulatory approval of CaPre; |

| |

the successful enrollment of patients in clinical trials as projected; |

| |

that the timeline and costs for Acastis clinical programs are not incorrectly estimated or affected by unforeseen circumstances; |

| |

the safety and efficacy of CaPre, successful GMP manufacturing and other activities leading up to planned regulatory filings as expected; |

| |

confirmation by the FDA of Acastis 505(b)(2) regulatory pathway approach with NCE status towards NDA approval in the United States and finalization of the protocol for the Phase 3 trial for CaPre within the anticipated timeframe; |

| |

Acastis receipt of 5 year market exclusivity for CaPre as a NCE; |

| |

positive outcome study data from two competitors in mild to moderate HTG patients; |

| |

that Acasti obtains and maintains regulatory approval for CaPre on a timely basis; |

| |

Acastis ability to attract, hire and retain key management and skilled scientific personnel; |

| |

the timely provision of services by third parties; |

| |

Acastis ability to maintain its supply of raw materials, including krill oil, from its parent company; |

| |

Acastis ability to secure and maintain a third-party supplier to provide Acasti, as needed, with raw materials to supplement its operations, including raw krill oil (RKO), in sufficient quantities and quality and on a timely basis to produce CaPre under cGMP standards; |

| |

Acastis ability to secure and maintain a third-party to manufacture CaPre whose manufacturing processes and facilities are in compliance with cGMP; |

| |

the Corporations ability to secure distribution arrangements for CaPre if it reaches commercialization; |

| |

the Corporations ability to manage future growth effectively; |

| |

the Corporations ability to gain acceptance of CaPre in its markets and Acastis ability to serve those markets; |

| |

the Corporations ability to achieve its publicly announced milestones on time; |

| |

the sufficiency and validity of Acastis patent portfolio; |

| |

the Corporations ability to secure and defend its intellectual property rights and to avoid infringing upon the intellectual property rights of third parties; |

| |

Acastis ability to take advantage of business opportunities in the pharmaceutical industry and the receipt of strategic partner support; |

| |

the assumption that Acastis projected capital requirements to fund anticipated expenses, including primarily development and general and administrative expenses, as well as capital expenditures until March 31, 2017 will prove to be accurate; |

| |

the Corporations ability to achieve profitability; |

| |

the Corporations ability to continue as a going concern; |

| |

Acastis ability to obtain additional capital and financing as needed on favorable terms; |

4

| |

the absence of significant increase in competition from other companies in the pharmaceutical, medical food and natural health product industries; |

| |

the assumption that CaPres concentrated omega-3s from krill oil are absorbed into the body more efficiently than omega-3 fatty acid ethyl esters derived from fish oils; |

| |

the assumption that CaPre would be viewed favorably by payers at launch (Tier 2 or 3 depending on payer plan); |

| |

the absence of material change in omega-3 prescription data as compared to omega-3 prescription data from 2009-2015; |

| |

the assumption that market data and reports reviewed by Acasti are accurate; |

| |

the absence of material deterioration in general business and economic conditions; |

| |

the absence of adverse changes in relevant laws or regulations; and |

| |

that any product liability lawsuits and other proceedings or disputes are satisfactorily resolved. |

In addition, forward-looking information in this document is subject to a number of known and unknown risks, uncertainties and other factors, including those described in this document under the heading Risk Factors and in the revised annual report on form 20-F of the Corporation for the fiscal year ended February 29, 2016, as filed on SEDAR under Acastis profile on May 30, 2016 under the heading Risk Factors, many of which are beyond the Corporations control, that could cause the Corporations actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking information, including, without limitation:

| |

failure to receive regulatory approvals (including stock exchange) or otherwise satisfy the conditions to the completion of financings and the funds thereof not being available to the Corporation; |

| |

risks related to timing and possible difficulties, delays or failures in clinical trials and patient enrollment; |

| |

anticipated pre-clinical and clinical trials may be more costly or take longer to complete than anticipated, and may never be initiated or completed, or may not generate results that warrant future development of CaPre; |

| |

CaPre may not prove to be safe and effective or as potent as currently believed; |

| |

clinical drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results; |

| |

anticipated studies and submissions to the FDA may not occur as currently anticipated, or at all; |

| |

rejection by the FDA of Acastis 505(b)(2) regulatory pathway approach; |

| |

the failure to receive 5 year market exclusivity for CaPre as a NCE; |

| |

negative outcome study data from two competitors in mild to moderate HTG patients; |

| |

difficulties, delays or failures in obtaining regulatory approvals for the initiation of clinical trials or to market CaPre; |

| |

the need for future clinical trials, the occurrence and success of which cannot be assured; |

| |

the risk of unknown side effects; |

| |

the FDA may refuse to approve CaPre, or place restrictions on its ability to commercialize CaPre; |

| |

uncertainties related to the regulatory approval process and the commercialization of CaPre; |

| |

the risk that CaPre could be subject to extensive post-market obligations and continued regulatory review, which may result in significant additional expense and affect sales, marketing and profitability; |

| |

failure to achieve Acastis publicly announced milestones on time; |

| |

difficulties in completing the development and commercialization of CaPre; |

| |

risks related to Acastis dependence on third party relationships to conduct its clinical trials for CaPre; |

| |

difficulties, delays, or failures in obtaining appropriate reimbursement of CaPre; |

| |

recently enacted and future legislation may increase the difficulty and cost for the Corporation to obtain marketing approval of and commercialize CaPre and affect the prices the Corporation may obtain; |

5

| |

Acastis business may be materially adversely affected by new legislation, new regulatory requirements, and the continuing efforts of governmental and third party payors to contain or reduce the costs of healthcare through various means; |

| |

uncertainty of the size and existence of a market opportunity for, and insufficient demand and market acceptance of, CaPre; |

| |

the Corporations reliance on third parties for the manufacture, supply and distribution of CaPre; |

| |

the Corporations dependence on Neptune and other third party manufacturers and key suppliers for the supply of raw materials, including RKO, in sufficient quantities and quality and to produce CaPre under cGMP standards; |

| |

Neptune currently exercises control over Acasti and has significant influence with respect to all matters submitted to Acastis shareholders for approval, including the election and removal of Acastis directors; |

| |

manufacturing risks, the need to manufacture to regulatory standards, uncertainty whether the manufacturing process for CaPre can be further scaled-up successfully or at all and the risk that clinical batches of CaPre may not be able to be produced in a timely manner or at all; |

| |

Acastis limited sales, marketing and distribution experience; |

| |

difficulties may be experienced in managing Acastis future growth; |

| |

Acastis dependence on its exclusive license with Neptune; |

| |

intellectual property risks, including the possibility that patent applications may not result in issued patents, that issued patents may be circumvented or challenged and ultimately struck down, and that Acasti may not be able to protect its trade secrets or other confidential proprietary information; |

| |

risks associated with potential claims of infringement of third party intellectual property and other proprietary rights; |

| |

risks related to potential product liability claims and product recalls; |

| |

intense competition from other companies in the pharmaceutical, medical food and natural health product industries; |

| |

the net proceeds of future financing and existing cash, together with interest thereon, may not be sufficient to fund Acastis operations through December 31, 2017; |

| |

Acastis projected capital requirements to fund anticipated expenses, including primarily development and general and administrative expenses, as well as capital expenditures until March 31, 2017 may prove to be inaccurate; |

| |

Acasti has a history of negative operating cash flow and may never become profitable or be able to sustain profitability; |

| |

Acasti will have significant additional future capital needs and may not be able to raise additional financing required to fund further research and development, clinical studies, obtain regulatory approvals, and to meet ongoing capital requirements to continue current operations on commercially acceptable terms or at all; |

| |

the Corporation may be unable to form or enter into commercial opportunities on its anticipated timeline, and may not realize the expected benefits of any such transaction; |

| |

the possibility that Acasti may acquire businesses or products or form strategic alliances in the future and may not realize the benefits of such acquisitions; |

| |

Acasti may be unable to secure development and/or distribution partnerships to support the development and commercialization of CaPre in the United States and in other global markets, and to secure strategic opportunities to provide development capital, market access and other strategic sources of capital; |

| |

Acastis reliance on key management and skilled scientific personnel; and |

| |

general changes in economic and capital market conditions. |

Consequently, all the forward-looking information in this document is qualified by this cautionary statement and there can be no guarantee that the results or developments that the Corporation anticipates will be realized or, even if substantially realized, that they will have the expected consequences or effects on the Corporations business, financial condition or results of operations. Accordingly, you should not place undue reliance on the forward-looking information. Except as required

6

by applicable law, Acasti does not undertake to update or amend any forward-looking information, whether as a result of new information, future events or otherwise. All forward-looking information is made as of the date of this document.

7

BUSINESS DESCRIPTION

Overview

Acasti was incorporated on February 1, 2002 under Part 1A of the Companies Act (Québec) under the name 9113-0310 Québec Inc.. On February 14, 2011, the Business Corporations Act (Québec) came into effect and replaced the Companies Act (Québec). Acasti is now governed by the Business Corporations Act (Québec). On August 7, 2008, pursuant to a Certificate of Amendment, the Corporation changed its name to Acasti Pharma Inc., its share capital description, the provisions regarding the restriction on securities transfers and the borrowing powers of the Corporation. On November 7, 2008, pursuant to a Certificate of Amendment, the Corporation changed the provisions regarding its borrowing powers. The Corporation became a reporting issuer in the Province of Québec on November 17, 2008.

Acastis head and registered office is located at 545 Promenade du Centropolis, Suite 100, Laval, Québec H7T 0A3. The Corporation currently employs 12 full-time employees with the majority working out of the Corporations headquarters in Laval and its laboratory in Sherbrooke. The Corporations website address is http://www.acastipharma.com.

Intercorporate Relationships

The Corporation has no subsidiaries. As of December 5, 2016, Neptune Technologies and Bioressources Inc. (Neptune) owns 5,064,694 Class A shares in the capital of the Corporation (Common Shares), representing approximately 47.28% of the issued and outstanding Common Shares.

Summary Description of the Business

Acasti is a biopharmaceutical innovator focused on the research, development and commercialization of prescription drugs using omega-3 fatty acids derived from krill oil. Acastis lead product candidate is CaPre® (omega-3 phospholipid), which Acasti is developing initially for the treatment of severe hypertriglyceridemia, a condition characterized by abnormally high levels of triglycerides in the bloodstream (over 500 mg/dL) (severe hypertriglyceridemia or severe HTG). Acasti believes the potential exists to expand CaPres indication to mild to moderate hypertriglyceridemia (200 499 mg/dL) with the likelihood of additional clinical trials being required such as comparative studies and outcome trials, assuming positive outcome study data in the next two years from two competitors. In addition, Acasti may seek to identify new potential indications for CaPre that may be appropriate for future studies and pipeline expansion. See Risk Factors.

Omega-3 fatty acids have extensive clinical evidence of safety and efficacy in lowering triglycerides in patients with hypertriglyceridemia. Market research commissioned by Acasti1, suggests there is a significant unmet market need for an effective, safe and well-absorbing omega-3 therapeutic that demonstrates a positive impact on the major blood lipids associated with cardiovascular disease risk. Acasti believes that, if supported by additional clinical trials, CaPre will address this unmet market need.

In four clinical trials conducted to date, Acasti saw the following beneficial effects with CaPre, and is seeking to demonstrate similar safety and efficacy in a Phase 3 clinical study:

| |

Significant reduction of triglyceride and non-high density lipoprotein cholesterol (non-HDL-C) cholesterol levels in the blood of patients with mild to severe hypertriglyceridemia; |

| |

No deleterious effect on low-density lipoprotein cholesterol, or bad cholesterol (LDL-C), and potential to reduce LDL-C; |

| |

Potential to increase high-density lipoprotein cholesterol, or good cholesterol (HDL-C); |

| |

Good bioavailability, even under fasting conditions; |

| |

No significant food effect (low fat vs. high fat meal); and |

1 Primary qualitative market research study with Key Opinion Leaders (KOLs), High Volume Prescribers (HVPs) and Pharmacy commissioned by Acasti in August 2016 by DP Analytics, A Division of Destum Partners, a market research firm (the Destum Market Research).

8

| |

An overall safety profile similar to that demonstrated by currently marketed OM3s, with added potential for beneficial LDL-C reduction as listed above. |

See Risk Factors.

About Hypertriglyceridemia (HTG)

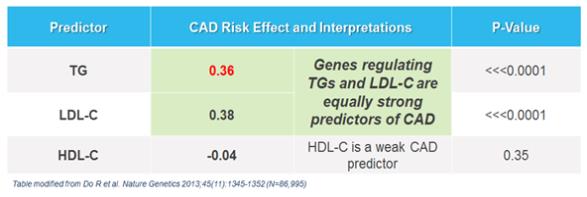

According to The American Heart Association Scientific Statement on Triglycerides and Cardiovascular Disease (2011), triglyceride levels provide important information as a marker associated with the risk for heart disease and stroke, especially when an individual also has low levels of HDL-C, and elevated levels of LDL-C. Hypertriglyceridemia can be caused by both genetic and environmental factors, including obesity, sedentary lifestyle and high-calorie diets. Hypertriglyceridemia is also associated with comorbid conditions such as chronic renal failure, pancreatitis, nephrotic syndrome and diabetes. Multiple genetic studies suggest that patients with elevated triglyceride levels (greater than or equal to 200 mg/dL) have an increased risk of coronary artery disease (CAD) and pancreatitis, a life-threatening condition, as compared to those with normal triglyceride levels. Other studies suggest that lowering and managing triglyceride levels may reduce such risks. In addition, the Japan EPA Lipid Intervention Study (JELIS) demonstrated the long term benefit of an omega-3 (EPA) in the prevention of major coronary events in high risk cardiovascular (CV) patients.2

About CaPre

CaPre is a krill oil derived mixture containing polyunsaturated fatty acids (PUFAs), primarily composed of omega-3 fatty acids, principally eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA). EPA and DHA are well known to be beneficial for human health, and may promote healthy heart, brain and visual function3, and may contribute to reducing inflammation, and blood triglycerides4. Krill is a natural source of phospholipids and omega-3 fatty acids. The EPA and DHA contained in CaPre are delivered as free fatty acids or bound to phospholipid esters, allowing these PUFAs to reach the small intestine where they undergo rapid absorption and transformation into complex fat molecules that are required for transport in the bloodstream. Acasti believes that EPA and DHA are more efficiently transported by phospholipids sourced from krill oil than the EPA and DHA contained in fish oil that are transported either by triglycerides (as in dietary supplements) or as ethyl esters in other prescription omega-3 drugs, which must then undergo additional digestion before they are ready for transport in the bloodstream.

CaPre is intended to be used as a therapy in conjunction with positive lifestyle changes including diet, and is to be administered either alone or with other drug treatment regimens such as statins (a class of drug used to reduce cholesterol levels). CaPre is intended to be taken orally once per day in capsule form.

Market for CaPre

2 Yokoyama et al, Lancet 2007 and Saito et al, Atherosclerosis 2008.

3 Kwantes and Grundmann, Journal of Dietary Supplements, 2014.

4 Ulven and Holven, Vascular health and risk management, 2015.

9

Except as otherwise indicated, all of the information under this heading has been derived from secondary sources including audited U.S. prescribing data and from a qualitative U.S. commercial and primary market research assessment conducted by DP Analytics, A Division of Destum Partners, Inc. (Destum), a market research firm, for Acasti dated August 19, 2016, which is referred to herein as the Destum Market Research. To conduct this market analysis for CaPre, Destum utilized secondary market data and reports and primary qualitative market research with physicians and third party payers (pharmacy benefit managers (PBMs)). One-on-one in-depth phone interviews lasting on average 30-60 minutes were conducted with 22 physicians and 5 PBMs, and key qualitative data was obtained on current clinical practice, unmet medical need, and commercial potential of CaPre. All interviews were conducted by the same individual at Destum and recorded to ensure consistency and collection of key data points. Destum utilized omega-3 prescription data from 2009-2015 for purposes of estimating the size of the market. Based on the discussions with the PBMs, Destum also assumed CaPre would be viewed favorably by payers at launch (e.g. Tier 2 or 3 depending on payer plan, which is comparable to VASCEPA®). Of note, upon completion of the screening questionnaire and upon approval for inclusion in the study, KOLs/HVPs were provided with a study questionnaire and were asked to comment on a target product profile offering a trifecta of cardio-metabolic benefits similar to the potential efficacy and safety benefits demonstrated by CaPre in two Phase 1 pharmacokinetic studies and two Phase 2 clinical trials (a Target Product Profile). Respondents were told that the unidentified product was being prepared for a Phase 3 study designed to confirm with statistical significance the safety and efficacy in patients with severe hypertriglyceridemia. Such a Target Product Profile was used by Destum strictly for market research analysis purposes and should not be construed as an indication of future performance and should not be read as any form of expectation or guarantee of future performance or results, and will not necessarily be an accurate indication of whether or not such results will be achieved by CaPre in any Phase 3 study.5

According to The American Heart Association, the prevalence of HTG in the United States and globally correlates to the aging of the population and the increasing incidence of obesity and diabetes. Market participants, including The American Heart Association, have estimated that one-third of the adult population in the United States has elevated levels of triglycerides (TGs) (of which only 4% are treated), including over 40 million people diagnosed with mild to moderate hypertriglyceridemia, and 3 to 4 million people diagnosed in the United States with severe hypertriglyceridemia6. Moreover, according to Ford, Archives of Internal Medicine in a study conducted between 1999 and 2004, 18% of adults in the United States (approximately 40 million7) had elevated TG levels equal or greater to 200 mg/dl8, of which only 3.6% were treated with TG lowering medication9, providing for a large underserved market opportunity.

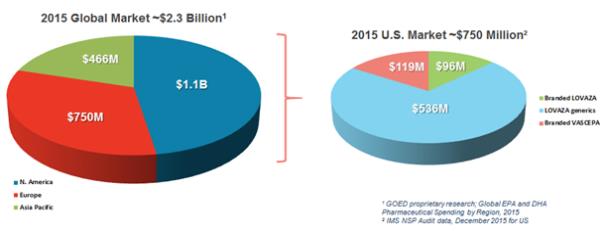

In 2015, CaPres target market in the United States for severe HTG was estimated to be approximately $750 million, with approximately 5 million scripts written annually over the past four years10. The total global market is currently estimated to be approximately $2.3 billion11, with the potential to greatly expand the treatable market to approximately 40 million patients with mild to moderate HTG, assuming favorable outcome studies that are currently ongoing. These outcome trials are expected to report in 2018 and 2019 (REDUCE-IT trial sponsored by Amarin and STRENGTH trial sponsored by Astra Zeneca, designed to evaluate the long-term benefit of lowering triglycerides on cardiovascular risks with prescription drugs containing omega-3 fatty acids). If these trials are successful, it is likely that additional clinical trials would be required for CaPre to expand its label claims to the mild to moderate segment.

The following charts illustrate the estimated global and U.S. markets for HTG in 2015:

5 The Corporation has also retained Destum as its exclusive advisor and business development consultant to identify strategic partners for CaPre, pursuant to which Destum may, subject to certain terms and conditions, be entitled to a success fee if a business arrangement or transaction is consummated. Destums market research and its conclusions were substantially completed, subject to some minor modifications, prior to this agreement having been entered into with Destum.

6 Christian et al., Am. J. Med. 2014.

7 Kapoor and Miller, ACC, 2016 (Kapoor).

8 Ford, Archives of Internal Medicine, 2009; 169(6):572-578 (Ford).

9 Ford. See also: Christian et al., Am. J. Cardiology, 2011.

10 IMS NSP Audit data, December 2015 for US.

11 GOED Proprietary Research; Global EPA and DHA Pharmaceutical Spending by Region, 2015.

10

CaPre has two FDA approved and marketed branded competitors (LOVAZA and VASCEPA). In addition, Astra Zeneca has an approved product, EPANOVA®, which has not yet been launched. LOVAZA generics became available on the market12 in 2013. In spite of generic options, audited prescription data13 suggests that over 50% of omega-3 prescriptions are written for branded products (LOVAZA or VASCEPA). Consequently, there has been only a 33% decline in total market value in the four years that generic competition has been available in the market, in spite of some generic switching that occurs at the pharmacies. This is in part due to the relatively small differential between branded and generic prices. Based on both primary market research with PBMs and audited prescription reports, the average pricing of generics is about $160/mo., while pricing for branded products average $250 - $300/mo. Amarin has raised prices on VASCEPA annually since launch in late 2013. Pharmacy Benefit Managers (PBMs) offer Preferred Brand status (Tier 2 or Tier 3), without significant restrictions (i.e. no prior authorization, step edits, or high co-payments).

In light of the following factors, Acasti believes a significant opportunity may exist for omega-3 market expansion:

| |

Cardiovascular diseases (CVD) and stroke are the leading causes of morbidity and mortality in the United States. The burden of CVD and stroke in terms of life-years lost, diminished quality of life, and direct and indirect medical costs also remains enormous; |

| |

In addition, evidence suggests potential for omega-3s in other cardiometabolic indications; and |

| |

Assuming two independent cardiovascular outcome trials (REDUCE-IT trial sponsored by Amarin and STRENGTH trial sponsored by Astra Zeneca) (the CV outcome trials) are positive, KOLs interviewed by Destum estimated that they would increase their own prescribing of omega-3s by 42% in mild to moderate HTG patients (200 499 mg/dL) and by 35% in severe HTG patients. |

Given that an estimated one-third of the adult population in the United States has elevated levels of triglycerides (of which only ~4% are treated), including over 40 million people diagnosed with mild to moderate hypertriglyceridemia and 3 to 4 million people diagnosed with severe hypertriglyceridemia14, Acasti believes there is potential for a 10-fold increase in the total number of patients eligible for treatment if the CV outcome trials are positive.

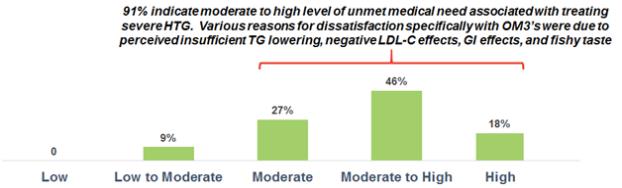

KOLs/HVPs interviewed by Destum were asked to assess the level of unmet medical need associated with treating patients with severe HTG based on currently available treatment options15. As illustrated in the graph below, 91% of physicians interviewed believed that the current unmet need was moderate to high. The various reasons stated for dissatisfaction specifically with currently available OM3s included perceived insufficient TG lowering, negative LDL-C effects, gastrointestinal side effects, and

12 IMS NSP Audit data, December 2015 for US.

13 IMS NSP Audit data, December 2015 for US.

14 Ford; Kapoor; Christian et al., Am. J. Cardiology, 2011.

15 The Destum Market Research.

11

fishy taste. Despite the availability of other drug classes to treat severe HTG, physicians would welcome new and improved omega-3 products.

Physicians responded favorably to a product with the CaPre target product profile (a Target Product) as evidenced by their weighted prescribing percentages of the Target Product by approximately 35% to 53% (range dependent on the specific profile presented) in the severe HTG patient population within two years of the Target Product approval16. About 60% of the respondents liked the trifecta effect of the Target Product on LDL-C and HDL-C, and the remaining 40% responded to the Target Products effective reduction of triglycerides. It should be noted that for purposes of this scenario, physicians were requested to assume the Target Product and all currently available omega-3 products were not subject to any reimbursement/coverage hurdles (e.g. equal playing field for all products).

Acasti plans to continue to conduct additional market research with KOLs, HVPs, primary care physicians and payers in the future to continue to develop and refine its understanding of the marketplace for CaPre.

Clinical Data

CaPre is currently being developed for the treatment of patients with severe hypertriglyceridemia. In two Phase 2 clinical trials (COLT and TRIFECTA), CaPre was found to be safe and well tolerated at all doses tested, with no serious adverse events that were considered treatment related. Among the reported adverse events with an occurrence of greater than 2% of subjects and greater than placebo, only diarrhea had an incidence of 2.2%.

In both studies, CaPre significantly lowered triglycerides in patients with mild to severe hypertriglyceridemia. Importantly, in these studies, CaPre also demonstrated no deleterious effect on LDL-C (unlike LOVAZA, which has been shown to significantly increase LDL-C in patients with severe HTG). Further, the Phase 2 data indicated that CaPre may potentially reduce LDL-C. LDL-C is undesirable because it accumulates in the walls of blood vessels, where it can cause blockages (atherosclerosis). In these studies, CaPre also reduced non-HDL-C, which includes all cholesterol contained in the bloodstream except HDL-C and is considered to be a useful marker of cardiovascular disease. The COLT data showed a mean increase of 7.7% in HDL-C with CaPre at 4 grams a day (p=0.07). Further studies are required to demonstrate statistical significance with HDL-C.

Acasti believes that these multiple potential benefits, if confirmed in a Phase 3 study, could be a significant differentiator for CaPre, as no currently approved omega-3 drug has shown an ability to positively modulate these four major blood lipid categories (e.g. triglycerides, non-HDL-C, LDL-C and HDL-C) in the treatment of hypertriglyceridemia. Acasti also believes that if supported by additional clinical trials, CaPre could potentially become the best-in-class omega-3 compound for the treatment of severe hypertriglyceridemia. See Risk Factors.

16 The Destum Market Research.

12

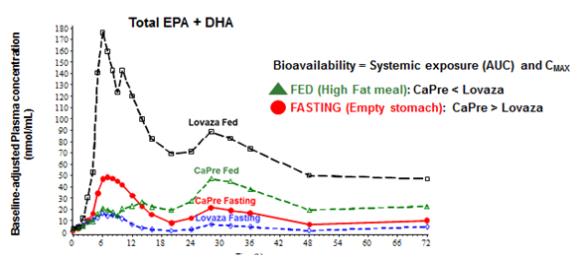

On September 14, 2016, Acasti announced positive data from its completed comparative bioavailability study (bridging study)17. The Bridging study was an open-label, randomized, four-way, cross-over, bioavailability study comparing CaPre given as a single dose of 4 grams in fasting and fed states with the approved hypertriglyceridemia drug LOVAZA (omega-3-acid ethyl esters) in 56 healthy volunteers. The protocol was reviewed and approved by the FDA. The primary objective of the study was based on a comparison of the bioavailability of CaPre as compared to LOVAZA administered as a single 4 gram dose with a high fat meal, which is the condition under which administration of OM3 drugs will yield the highest levels of EPA and DHA in the blood, and therefore the highest potential for toxicity. To allow for reliance on the safety data of LOVAZA to support a 505(b)(2) NDA for CaPre, results had to show that the blood levels of EPA and DHA resulting from a single, 4 gram dose of CaPre are not significantly higher than from a single, 4 gram dose of LOVAZA under fed conditions. The study met its primary objective and demonstrated that the levels of EPA and DHA following administration of CaPre did not exceed the levels following administration of LOVAZA in subjects who were fed a high-fat meal. These results are expected to support the basis for claiming a comparable safety profile of the two products.

Furthermore, among subjects in the fasting state, CaPre demonstrated better bioavailability than LOVAZA, as measured by superior blood levels of EPA and DHA.

The graph below demonstrates that the bridging study achieved all of its objectives:

PK Bridging Study Protocol: 2016-4010: A Single-Dose, Comparative Bioavailability Study of CaPre 1 gram Capsules Compared to LOVAZA 1 g Capsules Under Fasting and Fed Conditions

Absorption of ethyl ester forms of currently available prescription omega-3 drugs derived from fish oil (e.g. LOVAZA and VASCEPA) require the breakdown of fats by pancreatic enzymes (lipases) that are produced in response to the consumption of high fat content meals in order to be optimally absorbed. Consequently, these ethyl ester formulations have demonstrated lower absorption and bioavailability when taken on an empty stomach, whereas absorption of CaPre, which is formulated as omega-3 phospholipids and free fatty acids, is not meaningfully affected by the fat content of a meal consumed prior to drug administration, as shown in the CAP13-101 study18. Since a low fat diet is typically a critical component for treatment of patients with severe hypertriglyceridemia, Acasti believes this could give CaPre a significant clinical and marketing advantage over the ethyl ester based OM3s (LOVAZA and VASCEPA).

17 PK Bridging Study Protocol: 2016-4010: A Single-Dose, Comparative Bioavailability Study of CaPre 1 gram Capsules Compared to LOVAZA 1 g Capsules Under Fasting and Fed Conditions.

18 Evaluation of CaPre Pharmacokinetics Following Single and Multiple Oral Doses in Healthy Volunteers. Protocol Number: CAP13-101. Final Clinical Study Report; January 08, 2015.

13

The CAP13-101 study was an open-label, randomized, multiple-dose, single-center, parallel-design study in healthy volunteers. Forty-two (42) subjects were enrolled into 3 groups of 14 subjects who took 1, 2 or 4 grams of CaPre, administered once a day 30 minutes after breakfast. The objectives of the study were to determine the pharmacokinetic profile and safety on Day 1 following a single oral dose and Day 14 following multiple oral doses of CaPre in individuals pursuing a low-fat diet (therapeutic lifestyle changes diet). The effect of a high-fat meal on the bioavailability of CaPre was also evaluated at Day 15. Blood samples were collected for assessment of EPA and DHA total lipids in plasma to derive the pharmacokinetic parameters.

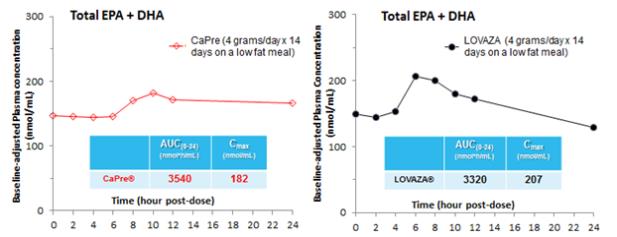

The PK profile of CaPre following multiple 4g doses obtained in the CAP13-101 study (at Day 14) was compared to the results obtained in a similar PK study (Offman 2013 - ECLIPSE 2) where LOVAZA was also administered at 4g a day for 14 days with a low fat diet. Although CaPre contains about 2.5 times less EPA/DHA compared to LOVAZA (approximately 310 mg/1 g capsule for CaPre versus 770 mg/1 g capsule for LOVAZA, CaPre plasma levels of EPA and DHA when administered with a low fat meal appear to be very similar to those of LOVAZA, as indicated by the AUC and Cmax. This study gives Acasti confidence in the dosing and design of the Phase 3 trial.

As demonstrated by the two graphs below, CaPre reaches similar blood and therapeutic levels to LOVAZA after 14 daily doses of CaPre at 4g/day, despite CaPre containing 2.5 times less EPA and DHA compared to LOVAZA:

| CAP13-101 Final Study Report, January 2015 |

EPA+DHA levels following LOVAZA were estimated from ECLIPSE II, Offman, VHRM 2013 |

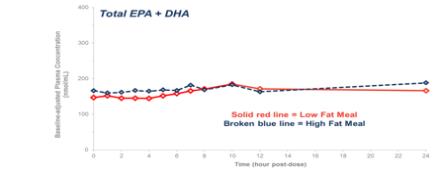

The graph below illustrates that the bioavailability of CaPre (total EPA+DHA levels in the blood) does not appear to be meaningfully affected by the fat content of a meal after multiple daily doses of CaPre at 4g/day (< 20% difference in AUC). This could represent a significant clinical advantage for CaPre since the administration with a low-fat meal represents a more realistic and attractive regimen for patients with hypertriglyceridemia who must follow a restricted diet.

Study CAP13-101 CaPre Pharmacokinetics Shows No Significant Food Effect

14

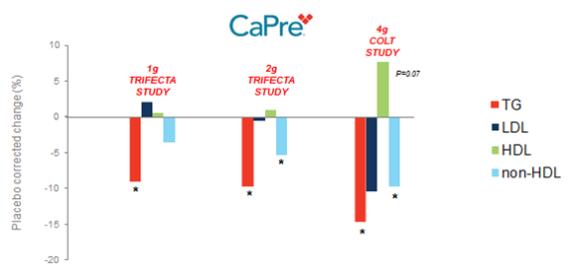

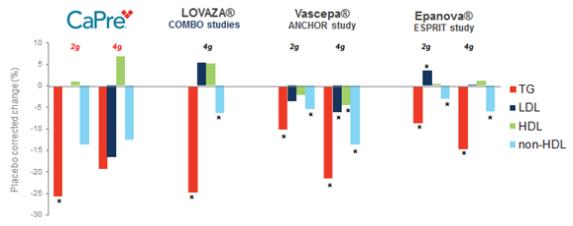

The graph below presents the effects of CaPre on the lipid profile obtained in Acastis two completed Phase 2 trials, TRIFECTA and COLT. 90% of the patients in these studies had mild to moderate HTG (levels between 200 499 mg/dL), and only 10% of patients had severely elevated TG levels between 500 and 877 mg/dL, the latter being the maximum level of TGs permitted per study protocol (Health Canada requirement). Only 30% of the patients were on a background of statins, which is important to note as statins appear to increase the TG lowering effect of OM3s.

This data shows that CaPre significantly reduces TGs, but unlike some other prescription OM3s (EPA/DHA products), it has no deleterious effect on LDL-C and may potentially increase HDL-C (p=0.07) the Trifecta Effect. Furthermore a dose response was seen with all of the major lipid markers.

Phase 2 Study Results Show CaPre Dose Response and Potential for Trifecta Lipid Effect:

* Indicates results reached statistical significance

COLT and TRIFECTA study data (TG population in mild to moderate is 90%. About 10% were severe.

Only 30% of all patients were on statins). TRIFECTA for 1g (N=130) & 2g (N=128) and COLT for 4g (N=62).

HDL-C results at 4g from COLT approached statistical significance at P=0.07.

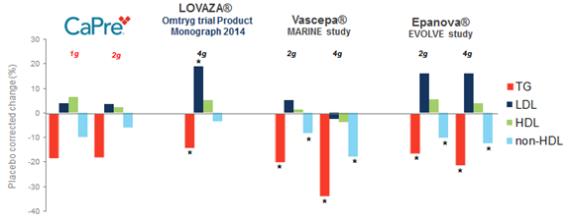

A subgroup analysis including only patients with severe HTG (approximately 10% of patients from the TRIFECTA study) was done to compare the effects of CaPre versus other OM3 drugs in the target population of patients with severe HTG. In spite of being given at a lower dose, the CaPre results compared very well with data from independent studies for the other prescription OM3 drugs approved for the treatment of severe HTG at higher doses of 2 and 4 grams. The results of this subgroup analysis are not statistically significant for CaPre, which may be due to the small sample size, but numerically the results compare well with other OM3 drugs. The results for LDL-C, HDL-C and non-HDL-C are based on descriptive statistics and are directional only (no statistical testing was conducted, and, as such, no P values were generated).

15

Sub-Group Analysis in Patients with Severe HTG: CaPre19 at 1 & 2 Grams Compares Well with Competition20 at 2 & 4 Grams:

Only ~1/3 of all patients across all studies were on statins

* Indicates results reached statistical significance

Statins appear to enhance the TG lowering property of OM3 drugs. Accordingly, a subgroup analysis was conducted including only patients who were taking a statin at baseline in the COLT and TRIFECTA studies (approximately 30% of the trial population). The graph below compares the TG lowering effects of CaPre to other OM3s, all on a background of a statin drug, showing that CaPres TG lowering effects compare well with these other approved OM3 drugs. Also note that the number of patients on statins in the CaPre group was low, with only 39 patients on 2 grams in TRIFECTA and only 22 patients on 4 grams in COLT.

The CaPre 2 gram bar represents the results from patients in the TRIFECTA trial on statins. A statistically significant reduction in TG (-25.7 % placebo corrected) was seen in that statin subgroup. The results for LDL-C, HDL-C and non HDL-C are based on descriptive statistics and are directional only (no statistical testing was conducted and, as such, no P values were generated).

The CaPre 4 gram bar represents patient results only from the COLT trial (there was no 4 gram arm in TRIFECTA). None of the results were statistically significant, which may be explained by the small number of patients (N=22).

As seen in the larger full study analyses, CaPre does not show any deleterious effect on LDL, and shows the potential to increase HDL (p=0.07). This will need to be confirmed in a Phase 3 trial.

19 Subgroup analysis on CaPre Phase 2 TRIFECTA study data in patients with severe HTG; (N=10 for 1g & N=14 for 2g). Results are not statistically significant for TG which may be explained by the small number of patients in this subgroup analysis. Results for LDL-C, HDL-C and non-HDL-C are based on descriptive statistics only (no statistical testing conducted).

20 Lovaza 4g (N=103), Vascepa 2g/4g (N=73/76), Epanova 2g/4g (N=100/99).

16

Sub-Group Analysis in Patients Treated with Statins21 vs Independent Competitor Data22: Potential for CaPre Trifecta Effect

* Indicates results reached statistical significance

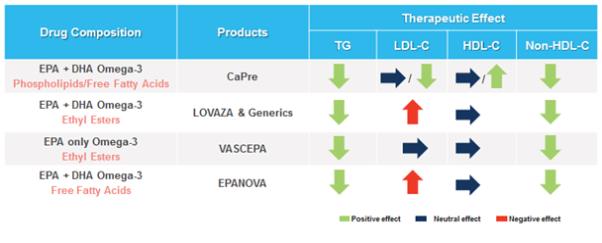

In summary, in addition to reducing triglyceride levels in patients with mild to severe hypertriglyceridemia, clinical data collected by Acasti to date has indicated that CaPre may also have beneficial effects on other blood lipids such as HDL-C (good cholesterol) and non-HDL-C. Also, clinical data collected by Acasti to date indicates that CaPre has no deleterious effect on, and may potentially reduce, LDL-C (bad cholesterol) levels. Lastly, the absorption of CaPre is not meaningfully affected by the fat content of a meal consumed prior to drug administration, which Acasti believes could give CaPre a significant clinical and marketing advantage.

CaPres potential clinical benefits as compared to currently approved competing products are summarized in the table below, suggesting that CaPre may deliver a more complete lipid management solution for patients with severe HTG23:

21 CaPre subgroup analyses on patients treated with statins: TRIFECTA for 2g (N=39) and COLT for 4g (N=22). For CaPre 2g, results for LDL-C, HDL-C, and non-HDL-C are based on descriptive statistics only (no statistical testing was conducted). For CaPre 4g, no results are statistically significant which may be explained by the small number of patients.

22 All patients on a statin background: Lovaza (N=122 for 4g), Vascepa (N= 234 for 2g, N=227 for 4g), Epanova (N=209 for 2g, N=207 for 4g). Statins have been shown to enhance the efficacy of OM3 products Vascepa NDA 202057. Statistical review, section 4.2 Other special/Subgroup populations, p. 107; and Maki K et al. Clin. Ther. 2013.

23 In Phase 2 clinical studies, CaPre showed positive effects on TGs, HDL-C and non-HDL-C, and no deleterious (and potentially positive effects) effects were noted on LDL-C. Competitor information from prescription information and SEC company filings.

17

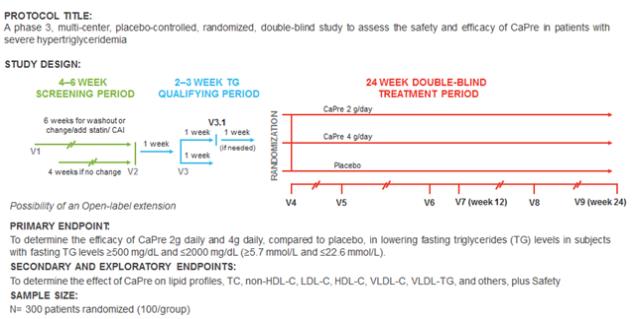

Planned Phase 3 Clinical Trial Design

The following chart illustrates the planned design and dosing of the Phase 3 clinical trial for CaPre. This plan and design will be submitted to the FDA, and is expected to be reviewed and discussed with the FDA in early 2017:

CaPre Regulatory Strategy

Acastis strategy is to develop and initially commercialize CaPre for the treatment of severe hypertriglyceridemia. The Corporation is currently aiming to initiate a Phase 3 trial in the second half of 2017, which would be specifically designed to fully evaluate the clinical effect of CaPre on triglycerides, non-HDL-C, LDL-C, and HDL-C levels together with a variety of other interesting cardiometabolic biomarkers in patients with severe hypertriglyceridemia. See Risk Factors.

In December 2015, Acasti announced that it intended to pursue a 505(b)(2) regulatory pathway towards an NDA approval in the United States. The 505(b)(2) regulatory pathway is defined in the United States Federal Food Drug and Cosmetics Act as an NDA containing investigations of safety and effectiveness that are being relied upon for approval and were not conducted by or for the applicant, and for which the applicant has not obtained a right of reference. These applications differ from the typical NDA (described under Section 505(b)(1) of the United States Federal Food Drug and Cosmetics Act), in that they allow a sponsor to rely, at least in part, on the FDAs findings of safety and/or effectiveness for a previously approved drug. Acasti intends to pursue this regulatory pathway as a strategy to speed up and streamline the development of CaPre, thereby reducing the associated cost and risk.

In order to qualify for the 505(b)(2) pathway, the FDA supported Acastis proposal to conduct a bioavailability bridging study that compared CaPre (omega-3 free fatty acid/phospholipid composition) with the already-approved HTG drug LOVAZA (omega-3-acid ethyl esters) in healthy volunteers. These results were discussed above and given that the primary study objective was met, these results are expected to support the basis for claiming a comparable safety profile of CaPre and LOVAZA. This supports Acastis plan to receive authorization to use the FDAs 505(b)(2) pathway, which would enable the Corporation to rely on the safety data of LOVAZA. The Corporation intends to meet with the FDA in early 2017 to confirm this regulatory approach, and to finalize the protocol for the Phase 3 trial needed for NDA approval. See Risk Factors.

Acasti is currently preparing for discussions with the FDA about the next steps for the development program of CaPre, including a Phase 3 clinical study in patients with severe hypertriglyceridemia. Such discussions are intended to allow the FDA to provide feedback on Acastis

18

regulatory plans and to clarify or answer specific questions that the FDA may have prior to initiating any Phase 3 clinical study. See Risk Factors.

The Corporations planned key milestones and development timeline are presented below.

CaPre Development Timeline and Key Milestones

Business Strategy

Intellectual Property Strategy

Pursuant to a license agreement entered into with Neptune in August 2008, as amended, Acasti has been granted an exclusive license to Neptunes intellectual property portfolio related to cardiovascular pharmaceutical applications (the License Agreement). The license allows Acasti to develop and commercialize its novel and active pharmaceutical ingredients (APIs) for the prescription drug and medical food markets.

As a result of the royalty prepayment transaction entered into between Neptune and Acasti on December 4, 2012, Acasti is no longer required to pay any royalties to Neptune under the License Agreement during its term for the use of the intellectual property under license.

As previously disclosed, Acasti had been marketing ONEMIA®, an omega-3 medical food supplement which has been marketed in the United States since 2011, and was also marketed as a natural health product in Canada since 2012. Acastis management decided in late 2015 to find distribution alternatives for ONEMIA to allow Acasti to focus its energy and resources exclusively on the development of CaPre. As a result, Acasti entered into a non-exclusive license agreement with Neptune for the sale and distribution of ONEMIA. Given the resulting low level of sales, Acasti recently decided to discontinue the production of ONEMIA and has notified all customers to that effect. As a result of the discontinuation of ONEMIA, Acasti does not intend to renew its non-exclusive license agreement with Neptune for the distribution of ONEMIA once it expires.

In addition to the license of Neptunes patents, Acasti continues to expand its own intellectual property (IP) portfolio and patents. Acasti has filed patent applications in 26 jurisdictions including Europe, North America, Asia and Australia for its Concentrated Therapeutic Phospholipid Composition to treat hypertriglyceridemia, and currently has 14 issued patents and 20 patents pending in 19 different countries. The last to expire Acasti patent is valid until 2030.

U.S. patents were granted to Acasti protecting a method of reducing serum triglyceride levels comprising administering a composition comprising about 66% phospholipid (PL) (US 8,586,567) and a method of treating HTG comprising administering a composition comprising about 60% PL (US 9,475,830). A U.S. continuation patent application was subsequently filed to pursue prosecution of composition of matter claims encompassing an extract comprising a PL content between about 60% to about 99%.

Acasti believes these patents increase the potential commercial opportunity for CaPre, including possible licensing and partnership opportunities. Acasti is committed to building a global portfolio of

19

patents to ensure long-lasting and comprehensive intellectual property protection, while also safeguarding valuable market expansion opportunities.

Acastis patent No. 600167 in New-Zealand, which is enforceable up until 2030, relating to a concentrated phospholipid composition comprising 60% phospholipid and method of using same for treating cardiovascular diseases has been opposed by BIO-MER Ltd. The corresponding Australian patent No. 2010312238 has been opposed by Enzymotech Ltd. Both oppositions are in early stages and only evidences against the validity of Acastis New Zealand patent has been submitted as of December 5, 2016, but it is important to note that no new prior art has been presented that was not already considered in other jurisdictions such as in the U.S. and Japan, where the Corporations patents are in force. See Risk Factors.

CaPre Manufacturing Process Overview

Acasti is developing CaPre as a NCE and is implementing the Phase 3 clinical program under current good manufacturing practices (cGMP), current good clinical practices (cGCP) and current good laboratory practices. All contract manufacturing organizations selected are cGMP compliant (both manufacturing and packaging sites). As batch sizes of 10-12 kg of CaPre have already been successfully produced and tested clinically, Acasti is now scaling up to 100 kg/day to fulfill the planned clinical product requirements for the Phase 3 trial. See Risk Factors.

Acastis Business and Commercialization Strategy

Key elements of Acastis business and commercialization strategy include initially obtaining regulatory approval for CaPre in the United States for severe hypertriglyceridemia, and to pursue development and/or distribution partnerships to support the commercialization of CaPre in the United States and in other global markets. Acastis preferred strategy is to commercialize through strategic partnerships. A late development-stage and differentiated drug candidate like CaPre could be attractive to various global, regional or specialty pharmaceutical companies. Acasti is taking an opportunistic approach to partnering and licensing in various geographies and indications. See Risk Factors.

Key goals of the Corporation include:

| |

Initiate and complete the Phase 3 clinical trial and, assuming the results of the Phase 3 clinical trial are positive, file an NDA to obtain regulatory approval for CaPre in the United States (initially for the treatment of severe hypertriglyceridemia) with the potential to expand the indication thereafter for the treatment of moderate to high hypertriglyceridemia, with the likelihood of additional clinical trials being required such as comparative and outcome trials assuming positive outcome study data from two competitors; |

| |

Continue to strengthen Acastis patent portfolio and other means of protecting intellectual property rights; |

| |

Acasti may pursue strategic opportunities including licensing or similar transactions, joint ventures, partnerships, strategic alliances or alternative financing transactions to provide development capital, market access and other strategic sources of capital for Acasti. However, we cannot assure when or whether Acasti will pursue any such strategic opportunities. See Risk Factors. |

The Corporation does not currently have in-house sales and marketing capabilities, and currently plans to seek an established marketing partner(s) for the sale and distribution of CaPre in the United States, and development and marketing partners for other major global markets. See Risk Factors. In addition to completing a Phase 3 clinical trial, Acasti expects that additional time and capital will be required to complete the filing of an NDA to obtain FDA pre-market approval for CaPre in the United

20

States, and to complete business development, marketing and other pre-commercialization activities before reaching commercial launch of the product, which will initially be for the treatment of severe hypertriglyceridemia.

The Corporation expects to focus initially on lipid specialists, cardiologists and primary care physicians who comprise the top prescribers of lipid-regulating therapies for patients with severe HTG as part of the sales and marketing strategy for CaPre. As part of its strategy, the Corporation intends to pursue various strategic opportunities intended to provide funding support for these development and commercialization activities. See Risk Factors.

21

RISK FACTORS

Investing in the securities of the Corporation involves a high degree of risk. Prospective and current investors should carefully consider the following risks and uncertainties, together with all other information in the Corporations Annual Report on Form 20-F for the year ended February 29, 2016, as filed with the SEC on May 31, 2016 (the 20-F), as well as the Corporations financial statements and related notes and Managements Discussion and Analysis (MD&A). Any of the risk factors described below could adversely affect Acastis business, financial condition or results of operations and the market price of Acastis Common Shares and other securities could decline significantly if one or more of these risks or uncertainties actually occur. Unknown risks or risks that Acasti currently believes to be immaterial may also impair its business, financial condition or results of operations. The Corporation cannot assure you that any of the events discussed in the risk factors will not occur. If any of such events does occur, you may lose all or part of your original investment in the Corporation. Certain statements below are forward-looking information. See Special Note Regarding Forward-Looking Statements in the 20-F.

General Risks Related to the Corporation

The Corporation may not be able to maintain its operations and research and development without additional funding.

The Corporation will require substantial additional funds to conduct further research and development, scheduled clinical testing, regulatory approvals and the commercialization of CaPre, including manufacturing and marketing capabilities, and, in the event that the Corporation is unable to secure a strategic partner, establishing a commercial sales force. In addition to completing nonclinical and clinical trials, the Corporations expects that additional time and capital will be required to complete the filing of an NDA to obtain FDA approval for CaPre in the United States and to complete marketing and other pre-commercialization activities. To date, the Corporation has financed its operations through public offering and private placement of Common Shares, proceeds from exercises of warrants, rights and options and research tax credits. The Corporations cash and short term investments (including its restricted short-term investment) were approximately $10.5 million as of February 29, 2016 and approximately $7.1 million as of October 31, 2016. Depending on the status of regulatory approval or, if approved, commercialization of CaPre, the Corporation will most likely require additional capital to fund its operating needs. To achieve the objectives of its business plan, the Corporation plans to establish strategic alliances and raise the necessary capital. The Corporation may also seek additional funding for these purposes through public or private equity or debt financing, joint venture arrangements, and collaborative arrangements with other pharmaceutical companies, and/or from other sources.

The Corporation has incurred operating losses and negative cash flows from operations since inception. If the Corporation is unable to secure sufficient capital to fund its operations, it may be forced to enter into strategic collaborations that could require the Corporation to share commercial rights to CaPre with third parties in ways that the Corporation currently does not intend or on terms that may not be favorable to the Corporation. There can be no assurance that any additional funding from any other third party will be available on acceptable terms or at all to enable the Corporation to continue and complete the research and development of CaPre. The failure to obtain additional financing on favorable terms, or at all, could have a material adverse effect on Acastis business, financial condition and results of operations.

We have no committed source of additional capital and if we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to significantly delay, scale back or discontinue the development or commercialization of CaPre or other research and development initiatives. We could be required to seek collaborators for our product candidates at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available or relinquish or license on unfavorable terms our rights to our product candidates in markets where we otherwise would seek to pursue development or commercialization ourselves.

The Corporation may never become profitable or be able to sustain profitability.

22

The Corporation is a clinical-stage biopharmaceutical company with a limited operating history. The likelihood of success of the Corporations business plan must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with developing and expanding early-stage businesses and the regulatory and competitive environment in which the Corporation operates. Biopharmaceutical product development is a highly speculative undertaking, involves a substantial degree of risk and is a capital-intensive business. Therefore, the Corporation expects to incur expenses without any meaningful corresponding revenues unless and until it is able to obtain regulatory approval and subsequently sell CaPre in significant quantities. The Corporation has been engaged in developing CaPre since 2008. To date, the Corporation has not generated any revenue from CaPre, and it may never be able to obtain regulatory approval for the marketing of CaPre in any indication. Further, even if the Corporation is able to commercialize CaPre or any other product candidate, there can be no assurance that the Corporation will generate significant revenues or even achieve profitability. The Corporations net loss for the fiscal year ended February 29, 2016 was approximately $6.3 million and approximately $7.5 million for the eight-month period ended October 31, 2016. As of February 29, 2016, the Corporation had an accumulated deficit of approximately $39.6 million and approximately $47.1 million as of October 31, 2016.

If the Corporation obtains FDA approval, it expects that its expenses will increase as it prepares for the commercial launch of CaPre. The Corporation also expects that its research and development expenses will continue to increase in the event it pursues FDA approval for CaPre for other indications. As a result, the Corporation expects to continue to incur substantial losses for the foreseeable future, and these losses may be increasing. The Corporation is uncertain about when or if it will be able to achieve or sustain profitability. If the Corporation achieves profitability in the future, it may not be able to sustain profitability in subsequent periods. Failure to become and remain profitable would impair the Corporations ability to sustain operations and adversely affect the price of the Common Shares and its ability to raise capital.

We currently have no marketing and sales organization and have no experience in marketing products. If we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our product candidates, we may not be able to generate product revenue.

We currently have no sales, marketing or distribution capabilities and have no experience in marketing products. If one of our product candidates is approved for sale, and we are unable to secure a strategic partner, we will be required to develop an in-house marketing organization and sales force, which will require significant capital expenditures, management resources and time. We will have to compete with other biotechnology and pharmaceutical companies to recruit, hire, train and retain marketing and sales personnel.

If we are unable or decide not to establish internal sales, marketing and distribution capabilities, we will pursue collaborative arrangements regarding the sales and marketing of our products, however, there can be no assurance that we will be able to establish or maintain such collaborative arrangements, or if we are able to do so, that they will have effective sales forces. Any revenue we receive will depend upon the efforts of such third parties, which may not be successful. We may have little or no control over the marketing and sales efforts of such third parties and our revenue from product sales may be lower than if we had commercialized our product candidates ourselves. We also face competition in our search for third parties to assist us with the sales and marketing efforts of our product candidates.

We cannot assure you that we will be able to develop in-house sales and distribution capabilities or establish or maintain relationships with third-party collaborators to commercialize any product in the United States or overseas.

Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and stock price.

23

Global credit and financial markets have experienced extreme volatility and disruptions in the past several years, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates and uncertainty about economic stability. We cannot assure you that further deterioration in credit and financial markets and confidence in economic conditions will not occur. Our general business strategy and stock price may be adversely affected by any such economic downturn, volatile business environment or continued unpredictable and unstable market conditions. If the current equity and credit markets deteriorate, it may make any necessary debt or equity financing more difficult, more costly and more dilutive. Failure to secure any necessary financing in a timely manner and on favorable terms could have a material adverse effect on our growth strategy, financial performance and stock price and could require us to delay or abandon development plans. In addition, there is a risk that one or more of our current service providers, manufacturers and other partners may not survive these difficult economic times, which could directly affect our ability to attain our operating goals on schedule and on budget.

If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research about our business, our share price and trading volume could decline.

The trading market for our common shares depends in part on the research and reports that securities or industry analysts publish about us or our business. If one or more of the securities or industry analysts who publish research about us downgrade our shares or publish inaccurate or unfavorable evaluations of our company or our stock, the price of our shares could decline. If one or more of these analysts cease coverage of our company, our shares may lose visibility in the market, which in turn could cause our shares price to decline.

If the Corporation is not successful in attracting and retaining highly qualified personnel, the Corporation may not be able to successfully implement its business strategy.

The Corporations ability to compete in the highly competitive pharmaceuticals industry depends in large part upon its ability to attract and retain highly qualified managerial, scientific and medical personnel. Competition for skilled personnel in the Corporations market is intense and competition for experienced scientists may limit the Corporations ability to hire and retain highly qualified personnel on acceptable terms. The Corporation is highly dependent on its management, scientific and medical personnel. The Corporations management team has substantial knowledge in many different aspects of drug development and commercialization. Despite the Corporations efforts to retain valuable employees, members of its management, scientific and medical teams may terminate their employment with the Corporation on short notice or, potentially, without any notice at all. The loss of the services of any of the Corporations executive officers or other key employees could potentially harm its business, operating results or financial condition. The Corporations success may also depend on its ability to attract, retain and motivate highly skilled junior, mid-level, and senior managers and scientific personnel. In addition, we do not maintain key person insurance policies on the lives of our executives or those of any of our other employees.

Other pharmaceutical companies with which the Corporation competes for qualified personnel have greater financial and other resources, different risk profiles, and a longer history in the industry than the Corporation does. They also may provide more diverse opportunities and better chances for career advancement. Some of these characteristics may be more appealing to high-quality candidates than what the Corporation has to offer. If the Corporation is unable to continue to attract and retain high-quality personnel, the rate and success at which the Corporation can develop and commercialize product candidates would be limited.

Neptune will have significant influence over matters put before shareholders.

Neptune currently owns approximately 47.28% of Acastis outstanding Common Shares and two members of Neptunes Board of Directors are also members of Acastis Board of Directors. As a result, Neptune exercises control over Acasti as of the date hereof, and will have significant influence with respect to all matters submitted to the Corporations shareholders for approval, including without limitation

24

the election and removal of directors, amendments to the articles of incorporation and by-laws of the Corporation and the approval of certain business combinations. Other holders of Common Shares will have a limited role in the Corporations affairs. This concentration of holdings may cause the market price of the Common Shares to decline, delay or prevent any acquisition or delay or discourage take-over attempts that shareholders may consider to be favourable, or make it more difficult or impossible for a third party to acquire control of the Corporation or effect a change in the Board of Directors and management. Any delay or prevention of a change of control transaction could deter potential acquirors or prevent the completion of a transaction in which the Corporations shareholders could receive a substantial premium over the then current market price for their Common Shares.

Neptunes interests may not in all cases be aligned with interests of the other shareholders of the Corporation. Neptune may have an interest in pursuing acquisitions, divestitures and other transactions that, in the judgment of its management, could enhance its equity investment, even though such transactions might involve risks to the other shareholders of the Corporation and may ultimately affect the market price of the Common Shares.

Neptune could lose its control of Acasti.

Neptune currently owns approximately 47.28% of Acastis outstanding Common Shares and two members of Neptunes Board of Directors are also members of Acastis Board of Directors. As a result, Neptune exercises control over Acasti as of the date hereof. However, if all outstanding warrants, call options and restricted share units of Acasti were to be exercised, Neptunes ownership interest in Acastis Common Shares would fall to approximately 36%. If Neptunes ownership of Acastis Common Shares declines, Neptune may lose its ability to elect members of its Board of Directors to Acastis Board of Directors and to otherwise exercise control over Acasti. A loss of Neptunes control over Acasti, could, among other things result in:

| |

investors and analysts placing a different, and possibly lower, value on the Common Shares to reflect a lower degree of exposure by Neptune to Acastis krill oil-based pharmaceutical business; and |

| |

Acasti making decisions in connection with the development and commercialization of Acastis products with less or no involvement and approval from Neptune. |